Trump’s IRS dismantling plan gains momentum amid claims of widespread tax fraud

04/09/2025 / By Finn Heartley

- IRS Collapsing Under Corruption: Mottahedeh claims the IRS is already failing due to inefficiency, relying on fear to enforce compliance while ignoring 80 million non-filers, including wealthy tax evaders.

- Jurisdictional Loophole: He argues federal income tax legally applies only to D.C. residents—not the 50 states—but decades of misapplication trap filers via self-incriminating 1040 forms.

- Silent Non-Filers Avoid Scrutiny: Treasury data shows millions skip filing without repercussions; IRS targets filers as “easy prey” due to resource constraints and self-reporting systems.

- Trump’s IRS Abolition Plan: Trump aims to replace IRS revenue with tariffs, but Mottahedeh asserts he could exempt states by enforcing the tax code’s limited D.C. jurisdiction.

- Hidden Inflation Tax: Even non-filers pay via Fed-driven currency devaluation. Mottahedeh urges asset conversion (e.g., gold) and challenges accountants to prove tax legality before compliance.

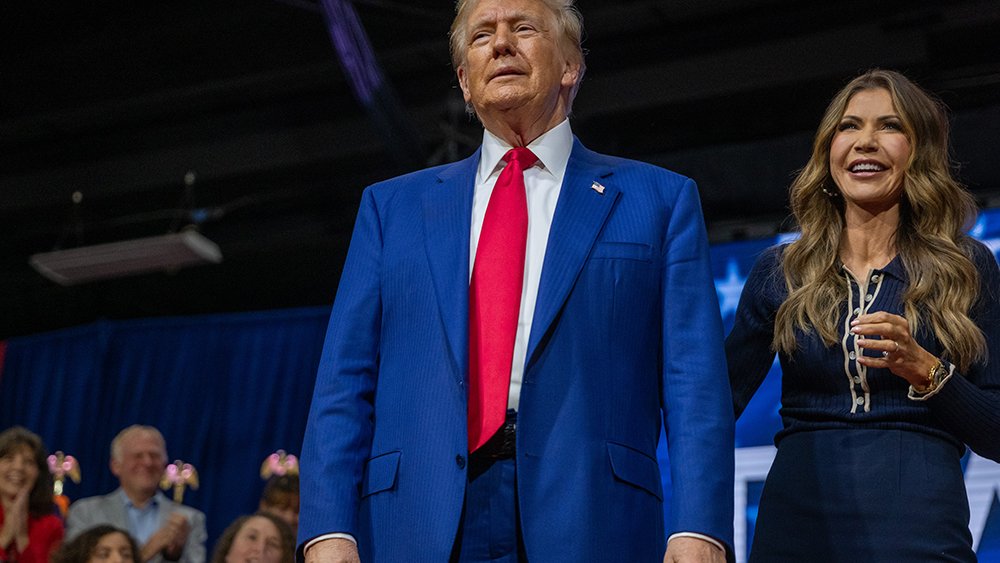

As President Donald Trump pushes forward with plans to dismantle the IRS, tax reform advocate Peymon Mottahedeh of Freedom Law School has revealed shocking claims that challenge the very foundation of federal tax enforcement. According to Mottahedeh, 80 million Americans already refuse to file tax returns, and the IRS—instead of cracking down—largely ignores them, prioritizing audits on those who do file.

The bombshell assertion? Federal income tax laws were never meant to apply to residents of the 50 states—only to Washington, D.C.—a legal loophole Mottahedeh argues has been obscured for decades.

“The IRS Preys on the Fearful—Not the Law”

During an explosive interview on Brighton.com, Mottahedeh, a 30-year veteran of tax resistance, asserted that the Internal Revenue Code’s jurisdiction is intentionally misapplied, compelling everyday Americans to unknowingly “confess” tax liability via the Form 1040—a document he calls “a self-incriminating trap.”

“The income tax and FICA payroll taxes legally only apply to residents of the District of Columbia, not the 50 states,” he explained. “The IRS thrives because people voluntarily sign 1040s under penalty of perjury.”

A Silent Majority Already Escapes IRS Scrutiny

Citing U.S. Treasury audits, Mottahedeh revealed:

- 80 million Americans earning above the minimum threshold don’t file returns—yet the IRS rarely pursues them.

- A 2020 Treasury report found 100 ultra-wealthy non-filers each owed ~$100 million in back taxes—yet the IRS ignored them due to “resource constraints.”

- Auditors prioritize filers because they’re easier targets, already locked into a system of self-reporting.

Mottahedeh’s advice? “Stop filing. The IRS won’t notice—they’re overwhelmed chasing those who do.”

Trump’s Tax Revolution: Abolish the IRS or Rein In Its Power?

Commerce Secretary Wilbur Ross recently confirmed Trump’s intent to eliminate the IRS entirely, replacing lost revenue with tariffs on foreign goods. But Mottahedeh argues Trump doesn’t need Congress—just enforcement of existing law.

“All Trump must do is declare IRS authority limited to D.C.,” he said. “The law already defines ‘United States’ as the District—not the states.” This move could overnight exempt working Americans from federal income tax without legislation.

The Hidden Inflation Tax: “You’re Paying Even If You Don’t File”

Though avoiding the IRS legally may be possible, host Mike Adams noted that all Americans still pay a hidden tax: inflation.

“The Federal Reserve’s money-printing devalues wages, acting as a stealth tariff on every dollar earned,” said Adams, holding up a Zimbabwean $10 trillion note as a warning. Mottahedeh agreed, urging listeners to convert cash into gold, land, or tangible assets before the dollar’s collapse.

Accountants vs. Truth: “Most Work for the IRS, Not You”

Mottahedeh compared CPA tax advisors to Big Pharma doctors—complicit in preserving a broken system. His challenge to skeptics?

“Ask your accountant to prove in writing that you must pay federal income tax. Offer to pay them to watch our 10-minute legal breakdown—if they can refute it, keep filing. If not, stop handing money to a corrupt agency.”

What Comes Next?

With Trump’s team already slashing 9,000 IRS jobs, the agency’s grip may soon loosen. Meanwhile, Mottahedeh’s Freedom Law School trains Americans to legally exit the tax system—freeing income for actual prosperity.

“We’ve been lied to since 1913,” Mottahedeh declared. “The power to defund tyranny is in your hands—if you dare use it.”

Watch the full episode of the “Health Ranger Report” with Mike Adams, the Health Ranger, and Peymon Mottahedeh as they reveal IRS secrets they don’t want you to know.

This video is from the Health Ranger Report channel on Brighteon.com.

More related stories:

DOGE targets IRS in sweeping government efficiency push

IRS fires 6,000 employees as Trump Administration targets government waste

IRS begins issuing Reduction In Force notices to employees in preparation for mass layoffs

Sources include:

Submit a correction >>

Tagged Under:

big government, debt bomb, Donald Trump, government debt, government efficiency, IRS, mass layoffs, money supply, pensions, privacy watch, risk, Risks, Taxes, Trump

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS