Trump’s 125% tariff triggers panic among Chinese Amazon sellers

04/11/2025 / By Cassie B.

- Trump raised tariffs on Chinese imports to 125%, shocking Chinese Amazon sellers.

- Chinese sellers dominating Amazon now face survival challenges in the U.S. market.

- Many sellers are raising prices up to 30% or abandoning the American market entirely.

- Critics warn of consumer price hikes while supporters see a path to revitalized American manufacturing.

- The move represents a broader shift toward economic nationalism and reduced dependence on China.

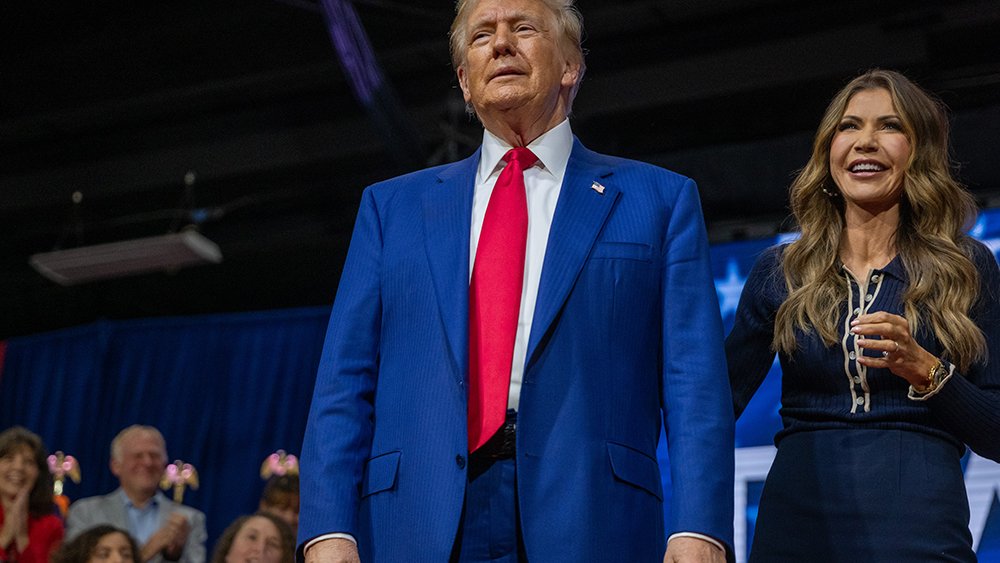

The Trump administration delivered a seismic blow to China’s e-commerce dominance this week, raising tariffs on Chinese imports to 125% — a decisive escalation in a years-long trade battle aimed at rebalancing an uneven playing field.

The move has sent shockwaves through the online marketplace, particularly for Chinese sellers flooding Amazon with inexpensive goods, many of whom are now scrambling to raise prices or abandon the U.S. market entirely. For American manufacturers, long squeezed out by cheap Chinese imports, the policy marks a pivotal step toward reclaiming economic sovereignty.

The tariff “bazooka” hits its mark

President Trump’s latest tariff hike — a response to China’s own 84% duties on U.S. goods — was framed as a necessary corrective to decades of unfair trade practices. The impact was swift: Chinese sellers, who account for over half of Amazon’s third-party marketplace, now face a devastating cost surge. Wang Xin, head of the Shenzhen Cross-Border E-Commerce Association, which represents 3,000 sellers, called the tariffs “truly an unprecedented blow” and warned, “It’ll be very hard for anyone to survive in the U.S. market.”

Data from SmartScout reveals China’s staggering foothold in e-commerce, with Shenzhen alone hosting over 100,000 Amazon businesses generating $35.3 billion annually. But the tariffs have upended their model. “This isn’t just a tax issue; the entire cost structure gets completely overwhelmed,” Wang told Reuters. Sellers like Dave Fong, who offers everything from schoolbags to Bluetooth speakers, have already raised U.S. prices by up to 30%. “You can’t rely on the U.S. market,” Fong admitted, shifting focus to Europe and Mexico.

A reckoning for “cheap junk” economics

For years, American manufacturers have decried the flood of low-quality, bargain-priced Chinese goods — many sold via Amazon — that undercut domestic production. Trump’s tariffs disrupt that pipeline, forcing Chinese sellers to either absorb unsustainable costs or cede ground. Brian Miller, a seven-year Amazon seller based in Shenzhen, predicts a mass exodus: “Manufacturing that serves the U.S. will have to be transferred to countries like Vietnam or Mexico.”

The move also exposes China’s vulnerability. Unlike the U.S., which boasts diversified imports, China’s export-driven economy relies heavily on American consumers. With tariffs slashing profitability, Chinese firms face a stark choice: raise prices (and lose competitive edge) or flee. One seller told Reuters that a toy, previously costing $3 to produce, now carries a $7 tariff — pushing retail prices up at least 20%. Higher-end items could jump 50%.

Short-term pain, long-term sovereignty

Critics warn of U.S. consumer price hikes, but proponents argue the tariffs are a vital investment in national economic security. “The silver lining is that high tariffs on China will begin to stop cheap Chinese junk flooding this nation,” noted Zero Hedge, framing the policy as a detox from dependence on fragile supply chains. The goal, supporters say, isn’t just punitive — it’s about rebuilding America’s industrial base.

While Beijing has threatened retaliation, its options are limited. China imports far less from the U.S. than it exports, leaving it with fewer targets. Meanwhile, Trump’s temporary 90-day pause on tariffs for other trading partners suggests a strategic carve-out to minimize global fallout.

The tariff spike underscores a broader realignment: globalization’s unchecked era is ending, and economic security is now national security. For U.S. policymakers, the challenge is ensuring that disrupted supply chains reshore production rather than simply relocate to other low-cost hubs. Early signs suggest some Chinese sellers may move operations to Mexico or Southeast Asia, but the ultimate prize—revitalized American manufacturing—remains within reach if domestic firms seize the opening.

This isn’t just a trade skirmish; it’s a fight for the future of U.S. economic independence. As Wang Xin acknowledged, the blow to China’s e-commerce machine is “unprecedented.” For American workers, it may be the opportunity they’ve waited decades for.

Sources for this article include:

Submit a correction >>

Tagged Under:

Amazon, big government, Bubble, business, chaos, China, Chinese sellers, Collapse, Donald Trump, economic riot, economy, finance riot, manufacturing, market crash, money supply, panic, progress, risk, supply chain, tariffs, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS