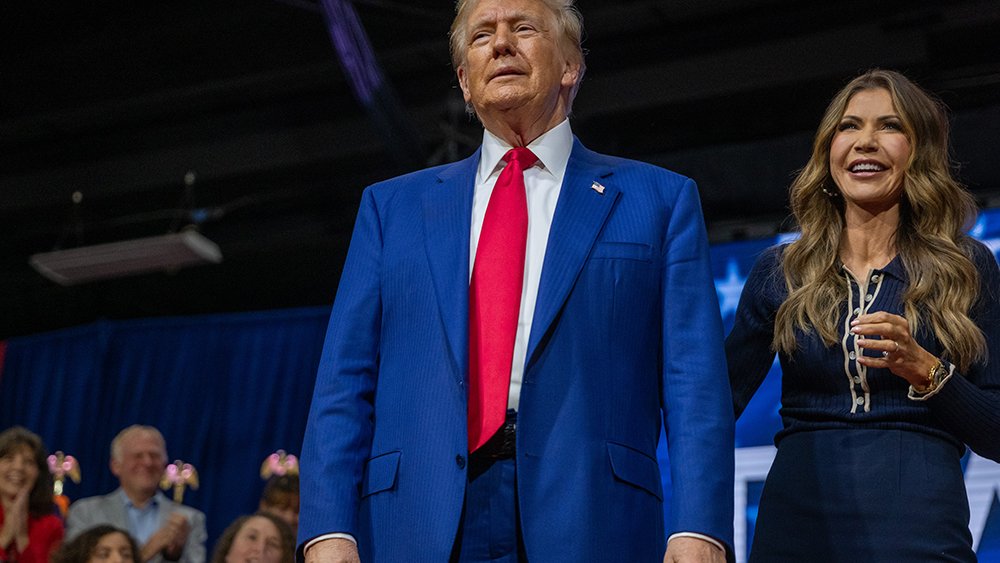

Market rebounds on Trump’s tariff pause, but uncertainty looms

04/11/2025 / By Willow Tohi

- Following President Donald Trump’s announcement of a 90-day pause on reciprocal tariffs, the Dow surged 2,962 points (7.87%), its largest single-day gain since March 2020. The S&P 500 rose 9.52%, its third-largest gain since WWII, and the Nasdaq jumped 12.16%, its second-best day ever.

- The rally followed a brutal market downturn, but optimism faded when the White House announced even higher tariffs (145%) on China, triggering a sell-off the next day. The Dow dropped 1,014 points, the S&P 500 fell 3.5%, and the Nasdaq lost 4.3%, reigniting economic uncertainty.

- Investor sentiment swung dramatically due to tariff announcements and policy shifts, with some analysts saying the worst-case scenario was avoided—but no long-term certainty yet.

Experts warn that trade negotiations will bring further market swings as each side seeks concessions. - Big Tech stocks (Nvidia, Tesla, Apple, Amazon) surged, with some posting 15–23% gains, while small-cap stocks (Russell 2000) also rebounded. However, the 10-year Treasury yield barely moved (4.39%), signaling ongoing inflation and recession concerns among bond investors.

- Analysts warn that trade tensions, Fed policy and recession risks remain major concerns, despite the temporary pause. The Fed faces challenges in balancing inflation and market stability, and a lasting trade resolution is needed for sustained growth.

In a dramatic turn of events, the U.S. stock market experienced one of its most significant rallies in history on Wednesday, following President Donald Trump’s announcement of a 90-day pause on reciprocal tariffs. The Dow Jones Industrial Average surged 2,962.86 points, or 7.87%, marking its largest single-day gain since March 2020. The S&P 500 skyrocketed 9.52%, the third-largest one-day gain since World War II, while the tech-heavy Nasdaq Composite jumped 12.16%, its second-best day ever.

Market reactions and economic context

The market’s explosive rally came as a relief to investors who had been bracing for a prolonged trade war and its potential economic fallout. The previous week had seen a brutal four-day stretch that pushed the S&P 500 into bear-market territory, with a 12% loss. The Dow lost more than 4,500 points, and the Nasdaq was down more than 13%. The sudden tariff pause, announced via Truth Social, was a pivotal moment that investors had been eagerly awaiting.

Gina Bolvin, president of Bolvin Wealth Management Group, commented, “This is the pivotal moment we’ve been waiting for. The immediate market reaction has been overwhelmingly positive, as investors interpret this as a step toward much-needed clarity.”

However, the relief was short-lived. On Thursday, the market took a sharp turn downward, with the S&P 500 dropping 3.5%, the Nasdaq Composite falling 4.3%, and the Dow Jones Industrial Average losing 1,014 points, or 2.5%. The White House’s confirmation that total tariffs on China would now be 145%—higher than the 125% initially announced—reignited fears of economic instability.

Tariff whiplash and market volatility

The market’s volatility over the past week highlights the significant impact of trade policy on investor sentiment. President Trump’s tariff announcements have been a double-edged sword, causing both sharp declines and dramatic recoveries. The 90-day pause on tariffs for non-retaliatory countries, while a positive step, has not fully alleviated concerns about the broader economic implications of the trade war.

Michael Kantrowitz, chief investment strategist at Piper Sandler, noted, “While uncertainty isn’t headed to zero, the worst-case scenario is off the table most likely. However, trade negotiations have yet to start, and once they do, there will be positive and negative headlines as each party positions itself to extract the maximum amount of concessions possible.”

Sector performance and economic indicators

Big Tech led the rally on Wednesday, with Nvidia soaring over 18%, Tesla adding almost 23%, and Apple, Amazon and Meta rallying about 15%. The Russell 2000, an index of small-cap stocks, also gained more than 7%, signaling a broader market recovery.

However, the bond market remained cautious. The 10-year Treasury yield, which had surged to 4.4% following the tariff pause, ended the day flat at 4.39%. This suggests that bond investors are still concerned about inflation and the potential for a recession, despite the market’s positive reaction.

Economic outlook and policy implications

The market’s roller-coaster ride has raised questions about the effectiveness of the Trump administration’s trade policies and the Fed’s role in stabilizing the economy. Former Treasury Secretary Larry Summers warned, “We are far from being out of the woods. Reckless improvisation is not a strategy, and total dishonesty about what is driving them is concerning.”

The Federal Reserve, which has been closely monitoring the market’s reaction to trade policy, faces a challenging task. Minneapolis Federal Reserve President Neel Kashkari stated, “The hurdle to change the federal funds rate one way or the other has increased due to the tariffs. In my view, the bar for cutting interest rates is higher to keep inflation expectations anchored.”

Conclusion

While the market’s dramatic rally on Wednesday provided a much-needed boost to investor confidence, the underlying economic uncertainties remain. The 90-day tariff pause is a positive step, but the ongoing trade negotiations and the potential for further tariff increases, particularly on China, continue to pose significant risks. As the market navigates these challenges, the Fed’s role in maintaining economic stability will be crucial. Investors will be closely watching for any signs of a lasting resolution to the trade tensions, which could provide the clarity needed for sustained market growth.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, dollar demise, economic indicators, economy, Inflation, market crash, money supply, pensions, risk, tariffs, trade war

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS