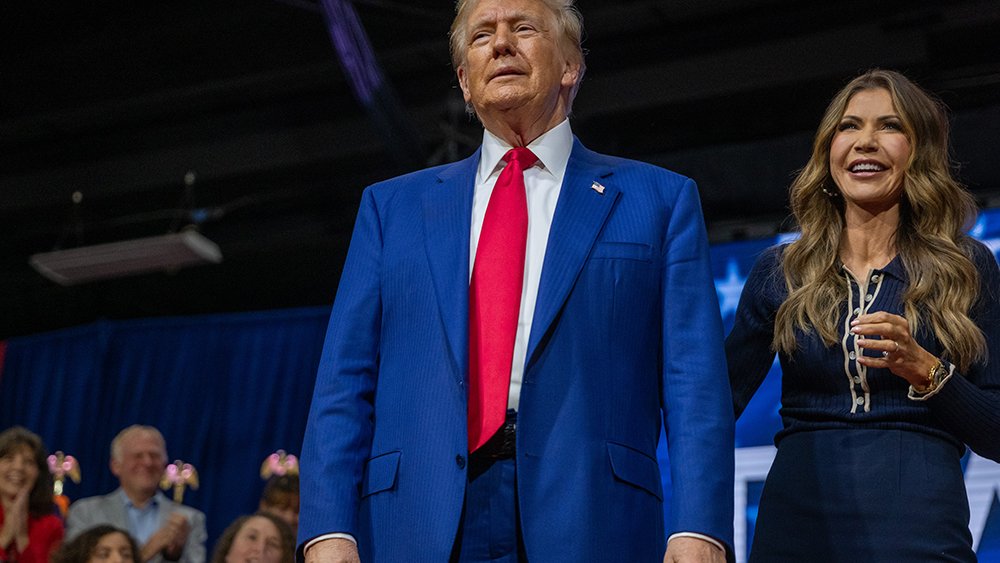

Gold surges to best day since October 2023 amid escalating U.S.-China trade war

04/10/2025 / By Lance D Johnson

As equities staged a historic rally Wednesday, another seismic shift was unfolding in the commodities market: gold surged by over $100, its sharpest single-day gain in months, as investors hedged against lingering economic uncertainty. While stocks celebrated President Trump’s tariff pause, the rush into gold and silver revealed deep-seated anxieties about the stability of global markets — particularly the U.S. Treasury system.

Key points:

• Gold prices skyrocket by 115, hitting 3,106.10 as investors flee to safety.

• U.S. Treasury yields spike to 4.38%, raising fears of market instability.

• China, Japan suspected of dumping U.S. Treasuries amid trade tensions.

• Analysts warn of a possible “Treasury market crisis” as hedge funds unwind positions.

• Silver also climbs, signaling broad-based demand for precious metals.

Why gold? A perfect storm of trade war fears and Treasury instability

June gold futures leapt to $3,106.10, just shy of its all-time high, as traders sought refuge from two looming threats: a full-blown U.S.-China trade war and potential turmoil in the Treasury market. With Trump raising tariffs on Beijing to 125% and China retaliating with 84% levies, investors fear prolonged economic disruption — and some suspect Beijing may retaliate by offloading U.S. debt.

“Gold is enjoying a tailwind from Chinese buying over concerns of yuan devaluation amid tariff impacts,” noted SP Angel, a brokerage firm. “However, concerns over the amount of leverage currently in the U.S. Treasury market may also push investors into gold as a haven asset.”

Analysts say hedge funds are racing to unwind leveraged Treasury positions, exacerbating bond market volatility. The 10-year Treasury yield surged to 4.38%, its highest in years, as prices fell — a sign that demand for U.S. debt may be waning.

Gold prices soared more than 2% on Wednesday, marking their strongest single-day gain since October 2023, as escalating U.S.-China trade tensions drove investors toward safe-haven assets. Spot gold rose 2.6% to 3,059.76 per ounce, nearing its earlier peak of 3,100, while U.S. gold futures jumped 3% to settle at $3,079.40. The rally was fueled by U.S. President Donald Trump’s decision to impose steep 125% tariffs on Chinese imports, exacerbating fears of economic instability and inflation.

Global trade war sparks demand for risk aversion

Trump’s aggressive tariff measures, effective immediately, triggered a flight from equities and industrial commodities into gold — a traditional hedge against geopolitical and financial uncertainty. Investor sentiment was further rattled by the Federal Reserve’s March meeting minutes, which highlighted persistent inflation risks and potential economic slowdowns. Market expectations of a June rate cut (priced at 72%) also supported gold, as lower interest rates reduce the opportunity cost of holding non-yielding bullion.

Gold has climbed over 400 this year, peaking at a 3,167.57 on April 3, bolstered by central bank purchases and sustained safe-haven inflows. Analysts like TD Securities’ Bart Melek noted that gold’s appeal is reinforced by rising inflationary pressures and bond yields, which amplify its role as a stability anchor. Meanwhile, silver rose 3.1%, benefiting from similar dynamics.

A historical echo: Will gold repeat its 2020 rally?

The current surge mirrors gold’s 30% explosion in 2020, when emergency Federal Reserve rate cuts sparked a flight to hard assets. This time, the trigger may be trade-fueled inflation and Treasury market instability. “Should investors worry about the stability of the U.S. government bond market, gold may provide the obvious alternative,” SP Angel warned.

With silver also climbing (May futures rose up to 30.40) the precious metals rally signals a broader distrust in fiat currencies and traditional markets. Technical analysts now see gold poised for a run at its record high 3,201.60, while silver eyes $32.00, which is still a fair price, as metals are expected to climb in trade value in the coming tumultuous years.

As traders await Thursday’s U.S. CPI data for further direction, gold remains a focal point in a landscape of trade volatility and monetary policy uncertainty. The metal’s resilience underscores its enduring status as a refuge in turbulent times.

Sources include:

Submit a correction >>

Tagged Under:

China, commodities, Donald Trump, Economic Uncertainty, Fed Policy, Federal Reserve, financial crisis, global economy, gold prices, Gold Rally, hedge funds, Inflation, investor sentiment, market instability, market volatility, Precious Metals, safe haven, silver prices, tariffs, trade war, trading, Treasury Market, Treasury Yields, US debt, Yuan Devaluation

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS