“Breaking Banks” explores the digital transformation of finance

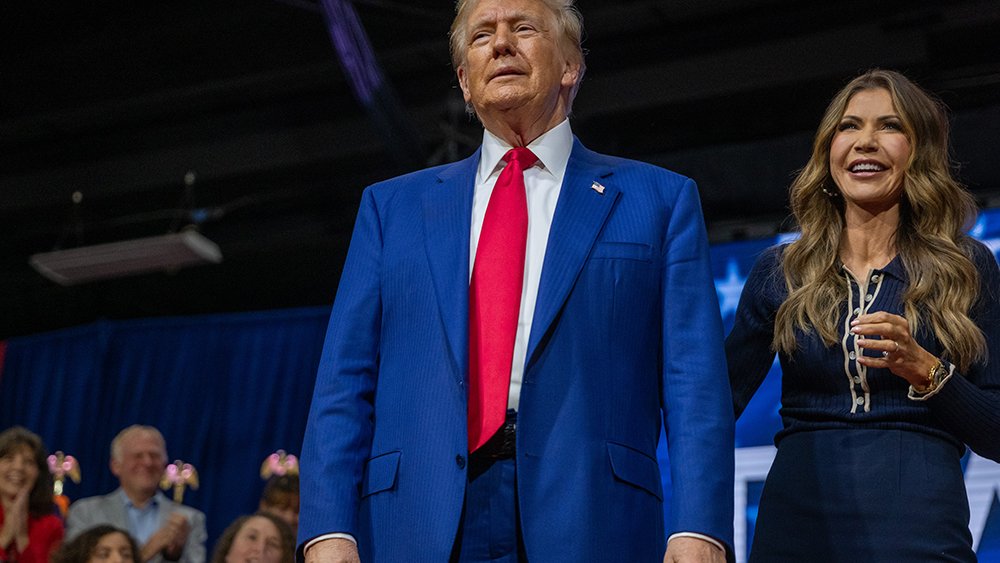

04/11/2025 / By Belle Carter

- “Breaking Banks” by Brett King explores the transformation of the banking sector driven by technology, changing consumer behavior and innovative strategies, focusing on how digital solutions are rebuilding trust and enhancing transparency and efficiency in lending.

- Lending practices date back to 3000 BC in Mesopotamia, where silver and barley were used as currencies, and interest rates were legally regulated. In the 21st century, lending encompasses various forms such as auto loans, student loans and mortgages.

- The crisis led to a significant increase in household debt, with U.S. and U.K. debt reaching 140 percent and 170 percent of income, respectively. Post-crisis, household debt has decreased, partly due to increased defaults, creating a gap for digital lending platforms to fill.

- Examples include Lending Club, which has a three percent default rate compared to Bank of America’s 24 percent in 2010, and Zopa, which uses advanced data analytics to achieve low default rates. Lenddo employs community vouching to enhance trust and reduce default rates in emerging markets.

- The future emphasizes seamless, invisible payments and the integration of technology such as mobile apps, voice recognition and biometrics. Banks are shifting towards real-time decision-making and embedding financing options into customer journeys, leveraging social media for engagement and trust-building.

In “Breaking Banks: The Innovators, Rogues, and Strategists Rebooting Banking,” Brett King takes readers on a journey through the evolving landscape of the financial industry, highlighting how technology, changing consumer behavior and innovative thinking are reshaping the traditional banking sector. The book, released in 2014, delves into the ways digital solutions are addressing the trust crisis in banking and offering more transparent, cost-effective and efficient lending options.

Lending, a practice that predates formal currency and the banking system by thousands of years, has roots tracing back to 3000 BC. Archaeological evidence shows that Mesopotamian merchants and lenders used silver and barley as primary currencies and stores of wealth, with interest rates regulated by law to prevent usury. Fast forward to the 21st century, and lending has become a ubiquitous aspect of daily life, with a variety of options available, including auto loans, student loans, payday loans, mortgages and credit cards.

However, the 2008 financial crisis left a significant mark, with household debt in the U.S. and U.K. skyrocketing to nearly 140 percent and 170 percent of income, respectively. While there has been a 20 percent decrease in household debt since then, much of this reduction is attributed to increased defaults rather than prudent saving. This crisis of trust has opened the door for entrepreneurs to step in with digital solutions.

One of the most notable examples of digital innovation is Lending Club, the largest peer-to-peer lender in the U.S., which has surpassed $3 billion in total loans with an effective default rate of just 3 percent. This is a stark contrast to the 24 percent default rate on mortgages that Bank of America experienced in 2010.

Giles Andrews, CEO and co-founder of Zopa, the world’s first peer-to-peer lending business, explained the success of his company: “Our default rates are below 0.8 percent, which is phenomenal compared to traditional banks. We use data more intelligently and incorporate alternative data sources. The peer-to-peer model also encourages borrowers to behave better because they are borrowing from other people, not faceless institutions.”

Lenddo, a company that helps people in emerging markets prove their identity and trustworthiness to access financial services, is another example of digital innovation. Jeff Stewart, CEO of Lenddo, highlighted the community vouching system they employ: “If your friends are willing to vouch for you, it counts for something. This approach has led to very low default rates because the community element plays a significant role in predicting repayment.”

The future of payments is all about making them invisible and frictionless. Companies like Dwolla are aiming for an experience where the payment process is seamless and nearly invisible. Dave Birch, a leading expert on digital money, pointed out, “The mobile phone is the critical inflection point in the history of payments, not plastic cards.”

Banks that insist on traditional methods, such as paper application forms and in-branch visits, are likely to struggle. The future is about automation, real-time decision-making and embedding financing decisions into the customer journey. For instance, imagine standing in a car dealership and receiving a financing pre-approval decision in real time on your smartphone.

Community is playing a crucial role in the future of banking. Whether it’s through social media engagement, as demonstrated by ASB Bank in New Zealand or through community vouching systems like Lenddo’s, banks are realizing that building trust and engagement with customers is key. Social media is not just a marketing tool; it’s a platform for dialogue, service and relationship-building.

Technology is the great enabler in this transformation. From voice recognition and biometrics to mobile apps and data analytics, technology is reshaping the banking experience. Andy Mauro from Nuance Communications explained, “Voice recognition and natural language understanding are becoming more sophisticated, allowing for more humanlike interactions with virtual assistants like Nina.”

According to Ron Shevlin from Aite Group, the competition will shift from branch location to performance, with banks competing to be the top-of-phone app. Kevin Travis from Novantas envisions a future with fewer branches and stronger online and mobile capabilities. Jerry Canning from Google sees a shift towards frictionless engagement, with technology like Google Glass providing real-time guidance and insights.

The traditional branch funnel is becoming obsolete as customer behavior changes. The future is about anticipating customer needs and delivering personalized, contextual advice in real time, wherever the customer is. “Breaking Banks” offers a compelling look at the innovations and strategies that are redefining the banking industry, making it essential reading for anyone interested in the future of finance.

Learn more about the book “Breaking Banks” by watching the video below.

This video is from the BrightLearn channel on Brighteon.com.

Sources include:

Submit a correction >>

Tagged Under:

banking industry, banking system, Breaking Banks, Brett King, Bubble, computing, cyber war, digital payments, Dwolla, finance, finance riot, future tech, Glitch, information technology, inventions, Lenddo, LendingClub, money supply, progress, risk, seamless banking, Zopa

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS