The FDIC is urging Americans to keep their money in the banks… practically an admission that you probably shouldn’t

03/29/2020 / By Ethan Huff

The Federal Deposit Insurance Corporation (FDIC) put out a video recently urging Americans not to withdraw their money from banks because the banking system is supposedly doing just fine. But if that’s really true, then why say anything about it at all?

FDIC Chairwoman Jelena McWilliams basically told America that the safest place to keep your money is in an FDIC-insured bank, even despite the economic catastrophe that looms from the Wuhan coronavirus (COVID-19) crisis.

With soft piano music playing in the background, McWilliams offered reassurance that “your money is safe at the banks,” and that “the last thing you should be doing is pulling your money out of the banks thinking it’s going to be safer somewhere else.”

It’s a nice sentiment, but does it bear any resemblance to reality? A good rule of thumb when it comes to the American banking Ponzi scheme is that if the government says everything is just fine and not to worry, the exact opposite is probably what’s really true.

In this case, McWilliams’ urgency in telling people to keep their money in the bank is probably an indicator that they shouldn’t, or at least that they should pay close attention to what’s going on in order to make changes in a flash, if necessary.

The fact of the matter is that there’s currently about $250 trillion worth of debt in the world right now, and much of that exists on the balance sheets of the United States. And with the novel coronavirus (COVID-19) halting the world’s economic system, the time is coming to pay the piper.

But will people actually be able to do that, seeing as how millions of Americans can no longer work? Will there actually be any money in circulation to service mortgages or student loans or credit cards?

Listen below to The Health Ranger Report as Mike Adams, the Health Ranger, talks to James Yeager about the Wuhan coronavirus (COVID-19) pandemic and the urgent need to brush up on your self-defense skills:

The FDIC only has enough cash to cover less than 1% of the entire banking system

While McWilliams is technically correct in stating that “not a single depositor has lost money since 1933,” the fact of the matter is that we’re now dealing with a whole new animal, the likes of which has never before been seen in human history.

Depending on how long this pandemic persists, the economic calamity it’s creating could be far more than what the FDIC could ever possibly insure.

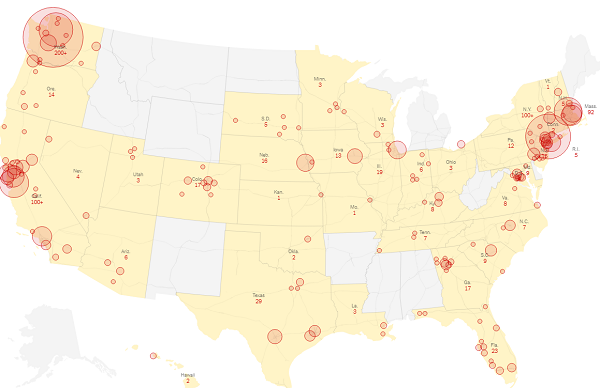

As it turns out, the FDIC only has about $109 billion on hand to insure the $13 trillion that makes up the American banking system. This adds up to less than one percent coverage capacity, which is nothing short of grim when considering the cascading economic effects of the Wuhan coronavirus (COVID-19).

“Neither the FDIC, nor any bank, has ever had to deal with a complete shutdown of the economy … or potential losses of this magnitude,” warns Sovereign Man.

“The Covid-19 impact on the banking system could be 10x bigger than the housing meltdown in 2008 … If the pandemic ends up causing trillions of dollars of loan losses, the FDIC won’t have enough ammunition to fix it … and that doesn’t even consider trillions of dollars more in potentially toxic derivatives exposure.”

In a nutshell, the FDIC is being less than honest in claiming that everything is 100 percent safe, here. And while we can’t make any recommendations about how to respond, we would simply advise that you read between the lines and make your own assessment of how to proceed.

More of the latest news about the Wuhan coronavirus (COVID-19) crisis is available at Pandemic.news.

Sources for this article include:

Tagged Under: banks, China, Chinese Virus, Collapse, coronavirus, covid-19, debt, disease, dollars, economic impact, economics, FDIC, fiat currency, finance, global emergency, Global Pandemic, infection, Jelena McWilliams, money, novel coronavirus, outbreak, pandemic, risk, stock market, virus, Wall Street, Wuhan, Wuhan coronavirus

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS