Wall Street sees most rapid 30% SELL-OFF in history over coronavirus outbreak, surpassing Great Depression’s plunge

03/24/2020 / By JD Heyes

If you were thinking that the Wuhan coronavirus (COVID-19) really isn’t that big of a deal and that people are making way too much of it, we don’t really know whether or not that’s true yet.

What we do know is that financial experts — people who make their living trading and forecasting stocks on Wall Street — sure think coronavirus is a big deal, especially after the week they’ve had.

Stock indices fell again on Monday after the Senate failed twice to pass emergency coronavirus relief measures that a growing number of lawmakers — and financial experts — say is vital if we’re to keep the economy President Trump so skillfully built intact.

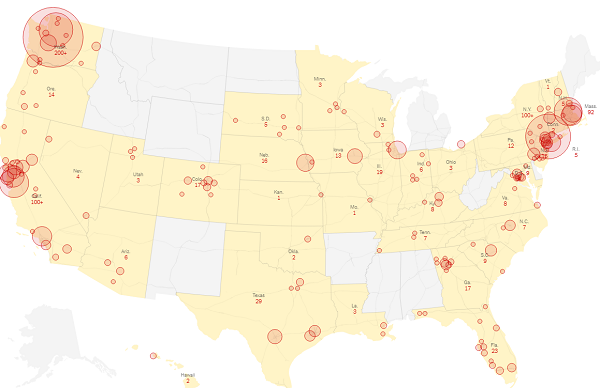

As reported by CNBC, the markets shed 30 percent last week and that was the fastest rate of decline in the history of Wall Street.

It was even faster than the dramatic sell-off that preceded the Great Depression.

That’s how big a deal coronavirus has become.

The financial news site noted:

Twenty-two days.

That’s all it took for the S&P 500 to fall 30% from its record high, the fastest drop of this magnitude in history.

The second, third and fourth quickest 30% pullbacks all occurred during the Great Depression era in 1934, 1931 and 1929, respectively, according to data from Bank of America Securities.

“This is not good company for 2020,” Stephen Suttmeier, a technical research strategist at the bank, said in a note Monday, according to the news site. “The 2020 correction continues to make history, having already claimed the title as the third fastest end to a bull market going back to 1928.”

The S&P (Standard&Poor’s) index fell almost 15 percent last week alone, which pushed the benchmark 32 percent overall below the all-time high reached just last month — Feb. 19.

Investors continued dumping equities at a fast clip as they grew more concerned that the economic fallout from the coronavirus will outpace any actions from governments and global central banks.

There is at least one bright spot

That includes the U.S. government, though it can’t be blamed on the Trump administration.

The president is waiting to sign emergency legislation that would immediately begin shifting financial support to the markets, to businesses, and directly to most American families. This is vital because at present, nearly one-third of our 327 million people are stuck in states where coronavirus lock-downs currently exist, with orders from governors that include mandatory shuttering of “non-essential” businesses. (Related: Former FDA commish warns America “losing time” to ward off coronavirus and avoid “tragic suffering” of epic proportions.)

Businesses that employ people, in other words. And now those Americans aren’t employed.

“At Friday’s new low of 2,305, the S&P 500 was on the cusp of exiting recession pricing and baking in a more onerous scenario,” Lori Calvasina, head of U.S. equity strategy at RBC, said in a note Monday, CNBC reported.

She noted further that the recent price action in the S&P 500 resembled how the index behaved during the financial crisis of 2008. If trends continue, the index could hit the 1,600-1,800 range before finally turning higher, she said.

Overall, Fox Business Network added, The Dow Jones Industrial Index is in for its worst performance since 1931.

The one bright spot — literally — on the day was gold, which always tends to rally when paper stocks and currency tank. It closed at about $1,57 an ounce after its biggest one-day percentage gain since March 2009, which, again, was during the Great Recession.

Initially, markets gained some ahead of the opening bell Monday but quickly dipped into negative territory when it became obvious that Democrats were going to continue politicizing the outbreak for their own gain by refusing to compromise with the GOP to get a bill done.

So again, while you may not think coronavirus is a big deal, the markets sure do. See MarketCrash.news for more news on the accelerating market crash.

Sources include:

Tagged Under: Collapse, Congress, covid-19, economics, gold, Great Depression, Great Recession, market crash, markets, plunge, record, relief bill, stock market, Wall Street, Wuhan coronavirus

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS