Coronavirus sinks Dow into bear market territory, other major indices down 5% – the bear is back with a vengeance

03/12/2020 / By Franz Walker

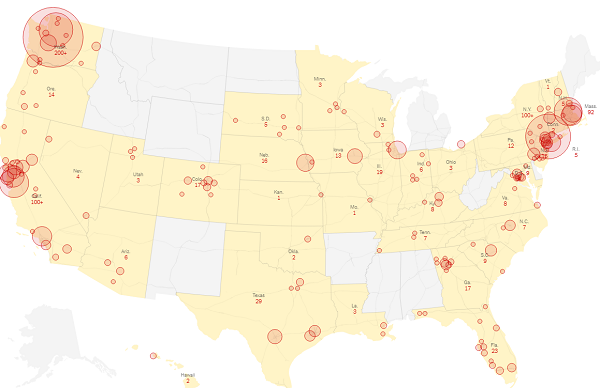

The coronavirus crushed U.S. stock markets anew, with the Dow Jones Industrial Average falling by 5.9 percent by closing bell on Wednesday. The 20.3 percent decline from its most recent high on February 12, 2020, also signals the end of the market’s decade-long bull run. This also marks a bear market, suggesting that investors have changed their view of the economy and possibly hinting at an upcoming recession. In line with the Dow, major indices also reported losses: The S&P 500 closed with a 4.9 percent deficit, 19 percent below its most recent high. Nasdaq, meanwhile, ended the day with a 4.7 percent decline.

This fall marks the first time a bear market has emerged since the 2008 global financial crisis. Back then, the S&P 500 lost over 57 percent after investment bank Lehman Brothers filed for bankruptcy, following the collapse of the subprime mortgage market in the United States. Since then, the closest indices have been to bear market territory was in December 2018, when indices fell just shy of a 20 percent drawdown during the trade war with China.

The fall comes as investors flee industries related to manufacturing, tourism, travel and anything else related to any public activity, causing billions in losses for any businesses involved in these sectors.

Travel stocks continue to fall

Travel is one of the biggest hit sectors as people cancel their trips, and governments restrict movement to contain the pandemic. Airlines are some of the hardest-hit businesses because of the outbreak. The International Air Transport Association (IATA) stated that the coronavirus could cost airlines as much as $113 billion in lost revenue – four times as high as their previous estimates, released just two weeks ago.

“The impact on airline profitability appears to be worsening by the day, and the spread of the virus and the impact on air travel has rapidly exceeded expectations of just a few days and weeks ago,” stated Ken Herbert, an industry analyst with Canaccord Genuity.

The reasons for the loss are a combination of travel restrictions imposed by governments and a decline in reservations as people begin to hold off traveling due to the virus. One of the airlines hit hard by declining bookings is Lufthansa, Germany’s largest airline. The airline, which owns several European carriers and operates over 83,000 flights a month, says it will be cutting up to 50 percent of its flights in the next few weeks, depending on how the outbreak develops. Before this, the airline had previously announced plans to cancel all flights to and from Israel after officials announced restrictions on travelers from a number of countries.

That said, some airline stocks have begun to recover as some carriers have begun to offer seats at reduced prices. Delta Air Lines shares rose by about 2 percent on Friday, while those of other U.S. carriers rose by smaller amounts.

In addition to airlines, cruise lines’ stocks have also been hammered since the start of the outbreak. The industry was hit hard after a number of ships were quarantined due to the virus. One of these ships, the Grand Princess remains quarantined at the sea just off San Francisco, though a number of passengers, including patients with confirmed infections, have disembarked. The ship’s owner, Carnival Cruise Lines, has seen its stocks drop by 47 percent. Meanwhile, shares of both Norwegian Cruise Lines and Royal Caribbean have lost more than 50 percent of their value.

Entertainment also down

Alongside travel, the entertainment industry is also suffering losses as parks shut down, and people avoid public spaces. Movie theater chains like AMC Entertainment Holdings, Cinemark Holdings and IMAX Corporation have seen their shares slump by as much as 30 percent in the last three months. In response to this, some studios are moving the release dates of their films: MGM, for instance, has moved the release of the upcoming James Bond film “No Time to Die” from its planned April release date to November.

Theme parks have also been hit hard by the outbreak. Disney has been forced to shut down its parks in Shanghai, Hong Kong and Tokyo. Meanwhile, Six Flags, Cedar Fair and SeaWorld Entertainment have seen their shares fall between 30 and 45 percent in the past month.

Workplaces disrupted

The ongoing outbreak has disrupted workplaces of companies around the country. Gap and Facebook closed offices after some of their employees came down with the disease. Meanwhile, a number of companies, including Microsoft and Facebook, have asked their employees to work from home if possible. (Related: Washington county of 2.2 million recommends ALL employees work from home as New York also declares state of emergency over coronavirus.)

In addition to this, Microsoft and Walmart have also postponed all non-essential business travel. The latter, the country’s largest employer, has restricted travel to conferences, trade shows and other events. It has also canceled its own U.S. Customer Conference in Dallas next week and will be holding a virtual conference in its place.

Stores benefiting from stockpile economy

It’s not all bad news as some companies have benefited from the wave of stockpiling caused by the outbreak. People have been loading up on supplies such as canned goods, toilet paper, rubbing alcohol and other cleaning products.

Costco owners Wholesale Corp. has become one of the few gainers in Wall Street, with its shares jumping by almost 11 percent this week. In a recent conference call, the company’s Chief Financial Officer Richard Galanti has described the buying frenzy as “off the charts.”

In the four weeks leading to February 22, sales of hand sanitizers in the U.S. soared 73 percent compared with the same period last year, according to market research firm Nielsen. Meanwhile, in the same period, sales of thermometers spiked by 47 percent. Online sales are also booming. Adobe Analytics reports that online purchases of toilet paper have nearly doubled. At the same time, those of non-perishable items like canned goods rose by almost 70 percent during the January and February period.

“This is a big time of anxiety, and we know the biggest source of anxiety is uncertainty,” stated Stewart Shankman, professor of psychiatry and behavioral sciences at Northwestern University. “People are trying to get a sense of control by buying things you really don’t need. It’s a false sense of control.”

Oil prices crash

While stockpiling may be driving prices of goods up, the price of oil has continued to drop. Oil prices crashed after following the implosion of an alliance between the Organization of the Petroleum Exporting Countries (OPEC) and Russia. OPEC, led by Saudi Arabia, wanted to increase the supply of oil to 3.6 million barrels through 2020 to take account of weaker consumption. However, Russian President Vladimir Putin worried that this move would cede too much ground to American oil producers. The split between OPEC and Russia has resulted in the former launching a price war that’s driven the price of oil down by more than 9 percent.

The lower price of oil could see some much-needed relief coming to big importing nations by lowering their energy bills. Consumers would also benefit from lower gas prices at the pump. However, the price war could have negative effects when combined with the lowered demand for oil from countries like China, which has shut factories down due to the outbreak. The lower demand could see major oil-producing countries lose money regardless of the market share they could claw back with the lower prices. Even U.S. companies, who have benefited from the shale oil boom, could be hurt from the low prices.

Federal support

Prior to the Dow slipping into bear market territory, the White House already stated that it would consider federal support for industries absorbing the brunt of the fallout from the coronavirus outbreak. However, according to Larry Kudrow, director of the president’s National Economic Council, the administration was not looking at a massive federal relief plan, but rather one that was “timely and targeted and micro.”

On Tuesday, the Federal Reserve made a surprise cut of its benchmark interest rate by a sizeable half-percentage point. This cut, the first of its kind since the financial crisis in 2008, led to a short-lived stock market rally. The Fed has followed this up by increasing the amount of money it’s providing to banks for overnight borrowing. This raised the top level to $175 billion from the $150 billion level it had set Monday.

In addition to the overnight facility, the Fed is extending its two-week repurchase agreement (repo) of at least $45 billion and is adding a one-month term repo of at least $50 billion. The new operations will start on Thursday and will continue through April 13. Meanwhile, the one-month term operations will happen on each of the next three Thursdays.

More action from the Fed is expected in the form of a 75 basis point interest rate cut by next week’s Federal Open Market Committee meeting. A further 25 basis point cut is also expected to come in the April meeting. The latter would take the Fed fund’s rate, used as a yardstick for short-term borrowing rates as well as other types of consumer debt, down to zero – the same rate it fell to during the financial crisis.

Sources include:

Tagged Under: Bubble, Collapse, coronavirus, covid-19, Dow Jones, economic collapse, economy, Federal Reserve, finance, financial crisis, government debt, market crash, pandemic, priority, risk, stock market, stocks

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS