Peter Schiff: Fed money magicians running out of rabbits

09/11/2023 / By News Editors

Most people think everything is fine. The Fed is getting inflation under control and soon they’ll be able to cut interest rates, keeping the economy from falling into a deep recession. In his podcast, Peter Schiff poured cold water on this narrative. He explains why the Fed won’t be able to repeat the magic it pulled off after the financial crisis and COVID.

(Article republished from SchiffGold.com)

Oil prices continued to climb last week. Meanwhile, bond yields also continue to push higher.

As Peter pointed out, one of the big reasons CPI came down so quickly was falling energy prices.

People forget oil prices fell almost 50% from their peak, and that fall ended in May of this year. But that big decline in oil prices was a major factor in bringing headline inflation from 9% to 3%. And it’s not just the rate hikes that did it. I mean, they were partially responsible because the rate hikes pushed up the dollar and the dollar going up brings oil prices down.”

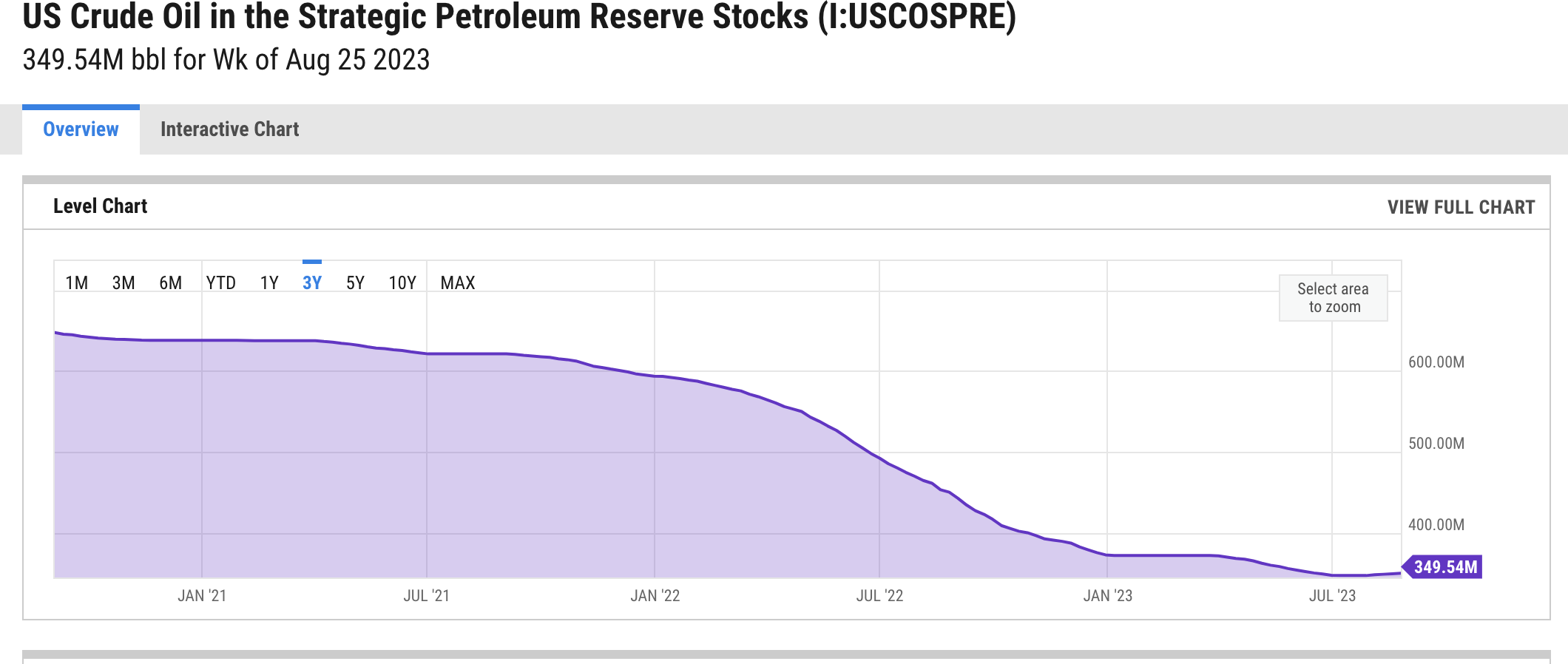

But Peter said there was another significant factor – President Biden selling oil from the strategic oil reserve. Today, reserves are at a 40-year low.

At this point, the US economy could only run for 20 days on the current oil reserves.

The point I’m making is there’s not much room now, given how low the reserves are. We can’t really keep selling. We can’t have no reserves. And we really can’t let them get any lower.”

Meanwhile, oil prices are now up 37% since the price bottomed out a few months ago.

All of that hasn’t even shown up yet. It’s just started. But we’re going to start to see that in the CPI numbers.”

And if the US tries to refill those reserves, it will put even more upward pressure on global oil prices. So, the bottom line is the US is no longer in a position where it can manipulate oil prices lower.

Remember, it was the money supply, the inflation, that was driving the prices higher because you have more money. But because we dumped all that oil out of the Strategic Oil Petroleum Reserve, we also had more supply. … That was unnatural. We can’t keep that up indefinitely because if we do, we’re going to run out of oil completely.”

The point is, they have already done that trick. They don’t have that rabbit to pull out of the hat anymore.

How is Biden going to keep the price of oil from going up? He’s not. So, inflation is going to continue to drive it higher, and that basically destroys this whole disinflation narrative.”

And so does what’s happening in the bond market.

Interest rates are rising, and oil prices are rising. So, energy is a major cost input for the economy that needs to be passed on to consumers. But so is interest. Because there’s one thing that Americans have in abundance and that’s debt. And that’s businesses too. … Everybody partook in this debt orgy when the Fed had interest rates at zero … and now they have to pay the bill.”

As businesses refinance debt at much higher interest rates, that increases their costs. It’s really no different than rent or the cost of materials going up.

The customer has to pay for all the costs of the business so the business can survive. And of course, the business has to make a profit. It can’t just be break-even. … So, you have to charge your customer more money than it costs you to provide the services he’s buying or produce the goods that he’s buying. As it costs you more to produce those goods and services, you have to raise your prices.”

In a nutshell, energy prices have gone up and interest rates have gone up. All of this is going to bleed into higher consumer prices. The markets still don’t get this.

The markets are still not reacting to the reality of what’s going on because they don’t even understand what’s going on.”

Most people are still optimistic that the Fed is close to winning the inflation fight. That means the central bank will be able to cut interest rates soon.

Everybody is waiting for the Fed to cut rates because there is no way the economy can survive if the Fed doesn’t cut rates. I think a lot of people may understand that. They just assume that it’s not going to be an issue, because of course, the Fed is going to cut rates.”

The only way the US government, American consumers, and businesses can handle their debt loads is if interest rates drop.

Everybody expects that’s what’s going to happen because inflation is going to come down. But it’s all predicated on the false belief that inflation can come back down to 2%, which it can’t. And if you’re looking at what’s happening with interest rates and oil, that’s obvious.”

This doesn’t look like an economy in the midst of disinflation.

We didn’t even get to 2%. We came down to 3%, and then we turned around, and we’re heading back up. It’s like a plane. It tried to land, and then it missed the landing, and it had to pull up. And now the pilot’s going right back up. That’s where we’re going with the CPI. The markets are not expecting this.”

Looking at the deeper market psychology, most people think there is very little risk in the stock market. Sure, it might go down. But the Federal Reserve won’t let it stay down,

Investors know that even if they screw up and the market tanks, and if the economy goes into a recession, which could impact earnings, the Fed is going to come in and cut the rates back to zero and everything is going to go back up.”

In this environment, fundamentals go out the window. Investors are willing to overpay for a stock because it will likely keep going up. If it goes down, the central bank will print a bunch of money and slash interest rates so we can borrow money, buy more stock, and drive the price even higher.

If markets weren’t expecting the Fed to bail them out, investors would not pay such high prices for stocks. It would be too risky.”

Investors are about to find out that safety net isn’t there anymore because price inflation is no longer low.

The only way the Fed was able to bail the economy out of the 2008 financial crisis was by creating inflation. They were able to do that because price inflation – the way they measure inflation – stayed around 2%. Then they created more inflation to get the economy out of the COVID government shutdown mess. That was the final straw. Over the last two years, we’ve seen the impact of inflation — money creation — in rapidly rising prices.

When price inflation is the problem, inflation can’t be the solution. You can’t solve the inflation problem by creating inflation. That is the bind.”

People don’t understand that the low price inflation we lived through for more than a decade was the aberration.

The problem is when the next disaster happens, the Fed can’t save us with more inflation. I mean, they can try. It won’t work. They may not try. Maybe they’ll realize it doesn’t work. But they’re not going to be able to get rates back to zero. They’re not going to be able to launch another round of QE.”

If the Fed does try to do what it’s done in the past — it will blow up the dollar.

There is no doubt in my mind that when this next crisis hits the banking system or the economy or the markets, it will be with inflation going up. So, the Fed is going to have to create more inflation when high inflation is the problem. And that makes it an even bigger problem. And then when the bottom drops out of the dollar, and then prices really take off, then everything the Fed is doing is backfiring.”

In other words, the Fed doesn’t have any more rabbits to pull out of its hat.

Read more at: SchiffGold.com

Submit a correction >>

Tagged Under:

big government, bond market, crisis, currency crash, debt bomb, debt collapse, deception, dollar demise, economic crisis, economic riot, economy, electricity, energy prices, Federal Reserve, fuel supply, government debt, Inflation, interest rate, Joe Biden, oil prices, oil supply, Peter Schiff, power, scarcity

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS