The American economy cannot afford another four years of a Biden presidency

05/01/2023 / By Arsenio Toledo

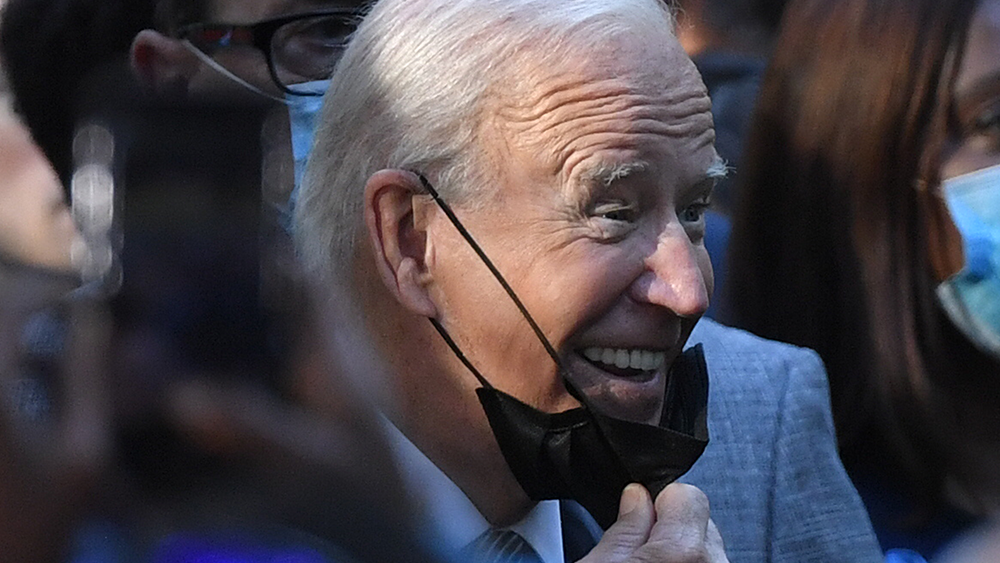

The economy of the United States would effectively collapse if President Joe Biden gets another full term.

This is according to financial expert Carol Roth, who noted in an opinion piece for The Blaze and during an interview with Glenn Beck that the president’s policies have disproportionately affected the American middle class.

“[Biden] and his cronies, they’ve been making themselves out to be champions of the middle class, but all they’ve done is decimate the middle class,” she said. (Related: Corporate America helped raise nearly $62 million for Biden’s inauguration.)

As a case in point, Roth pointed out how Biden’s Internal Revenue Service is hiring tens of thousands of new agents over the next few years with a massively inflated budget of $80 billion, and that these new agents will likely be sent after lower and middle-class Americans.

“You don’t have $80 billion to go after the 800 billionaires,” said Roth.

Roth also pointed out that the solutions Biden has presented for the many different crises during his first two years in office have negatively affected the American middle class. These negative effects include rising energy costs and record-high inflation.

Biden’s government continues to widen the budget deficit with reckless spending

To prove Roth’s point, the non-partisan Congressional Budget Office (CBO) released a report noting how the federal budget deficit reached $1.1 trillion in the first six months of the 2023 fiscal year, which began on Oct. 1, 2022. This represents a 63 percent jump in spending, or around $430 billion, over the same period in the previous fiscal year.

“Let’s say this and then pause for a minute: In six months, we have spent more money than we [ever] had, to the tune of $1.1 trillion,” noted Beck.

“And there is no emergency going on [that] they can hide this under, ‘Oh, it’s [Wuhan coronavirus] COVID-19,’ or there’s something special,” commented Roth. “This is just the trajectory of spending that they are putting us on the path to.”

Government spending is 13 percent higher so far this fiscal year compared to the last year, while revenues have dropped by three percent.

The deficit for March was $378 billion, according to monthly budget figures released by the Department of the Treasury. The increase in spending in the first six months of the fiscal year was driven by higher spending on debt interest payments, healthcare benefit payouts and education.

Interest payments on America’s outstanding debt in the first six months of fiscal 2023 totaled $384 billion, a 32 percent increase over the same period in the last fiscal year. The CBO noted that the increase is primarily caused by the Federal Reserve lifting its benchmark interest rate, mistakenly believing it would help combat inflation. This forced the government to pay higher returns to purchasers of Treasury securities.

The Department of Health and Human Services spending jumped by five percent to $843 billion due to increasing Medicare and Medicaid expenses, while the Department of Education spending rose by a whopping 76 percent to $124 billion due to Biden’s insistence on forgiving student loans.

Social Security spending also increased by 1o percent, and the Federal Deposit Insurance Corporation paid out an additional $29 billion following the collapse of Silicon Valley Bank and Signature Bank.

Learn more about President Joe Biden’s policies, including his economic agenda, at JoeBiden.news.

Watch this clip from “The Glenn Beck Program” on The Blaze as host Glenn Beck interviews financial expert Carol Roth about how another Biden term would bankrupt America.

This video is from the High Hopes channel on Brighteon.com.

More related stories:

Survey shows nearly 7 in 10 adults have a negative view of the US economy.

Homeowners with good credit being PUNISHED with Biden redistribution of high-risk loan costs.

Hunter Biden, other members of Biden family received MILLIONS from business associate linked to CCP.

Sources include:

Submit a correction >>

Tagged Under:

Biden presidency, big government, Bubble, budget deficit, Carol Roth, Collapse, debt bomb, debt collapse, economic collapse, economy, finance riot, government debt, government spending, Joe Biden, market crash, money supply, national debt, spending, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS