“This just makes no sense”: European regulators rush to calm AT1 investors after Credit Suisse wipeout shock

03/21/2023 / By News Editors

14 years ago, the Obama administration (or rather his Wall Street lackey Steve Rattner) turned the bankruptcy process on its head with the Chapter 11 filing of General Motors, which steamrolled the bankruptcy liquidation waterfall by paying off the underfunded (and unsecured) pension plans of GM and Chrysler union workers at 40 cents on the dollar, while cramming down secured creditors, forcing them to accept 29 cents on the dollar in recovery.

(Article by Tyler Durden republished from ZeroHedge.com)

On Sunday, something similar happened with Credit Suisse when, much to the shock of Europe’s $275 billion Additional Tier 1 market, some $17BN in Credit Suisse AT1, aka Contingent Convertible, bonds were wiped out even as equity holders received over $3 billion in consideration from UBS courtesy of Swiss taxpayers who ended up footing billions in contingent liabilities.

Not surprisingly, this morning the entire universe of riskiest bonds of European lenders – those in the AT1 tier – plunged after UBS agreed to buy the bank in a historic, government-enforced deal aimed at containing a crisis of confidence that had started to spread across global financial markets. It was the biggest loss yet for Europe’s AT1 market, which was created after the financial crisis to ensure losses would be borne by investors not taxpayers.

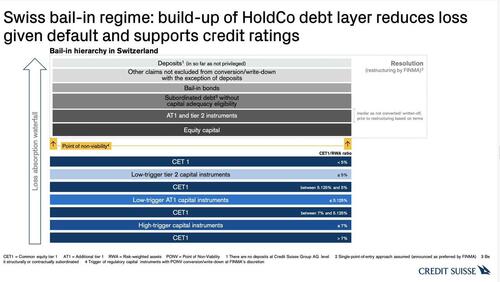

As shown in the Credit Suisse presentation chart below, in a typical writedown scenario, shareholders are the first to take a hit before AT1 bonds face losses. That’s why the decision to write down the bank’s riskiest debt — rather than its shareholders — provoked a furious response from some of the bondholders.

“This just makes no sense,” said Patrik Kauffmann, a fixed-income portfolio manager at Aquila Asset Management, who holds Credit Suisse CoCos. “Shareholders should get zero” because “it’s crystal clear that AT1s are senior to stocks.”

— Sean Tuffy (@SMTuffy) March 20, 2023

As noted last night, the wipeout of 16 billion francs ($17.2 billion) of Credit Suisse’s so-called AT1 bonds is the biggest loss yet for Europe’s $275 billion market in these securities, which were created after the financial crisis to ensure losses would be borne by investors not taxpayers.

Realizing that the chaos and fury among AT1 investors could spark the next leg of market contagion, on Monday morning European regulators rushed to reassure investors that shareholders should face losses before bondholders after the takeover of Credit Suisse Group AG wiped the bank’s Additional Tier 1 debt while preserving over $3 billion in equity value.

Junior creditors should bear losses only after equity holders have been fully wiped out, according to a joint statement from the Single Resolution Board, the European Banking Authority and the ECB Banking Supervision, who apparently were not consulted on Sunday during the whirlwind decisions that preserved some equity value at CS while wiping out its entire AT1 tranche.

Other European officials also weighed in. ECB Governing Council member Ignazio Visco said at an event in Milan that that regulators have the tools to deal with liquidity problems, but there are no issues currently. Italy’s Finance Minister Giancarlo Giorgetti said the risk for Italian banks is “not significant.” He added that he was “surprised” by the Swiss decision to prioritize shareholders over some bondholders.

As Bloomberg notes, the clauses that led to the bonds being marked to zero aren’t common. Only the AT1 bonds of Credit Suisse and UBS Group AG have language in their terms that allows for a permanent write-down and most other banks in Europe and the UK have more protections, according to Jeroen Julius, a credit analyst at Bloomberg Intelligence.

If the AT1 new-issue market reopens, equity conversion may become the dominant loss-absorption mechanism to reassure investors that they won’t be wiped out ahead of shareholders, BI’s Julius said.

Yet, judging by the market action, investors aren’t sticking around to find out. All kinds of risky bank debt tumbled on Monday and analysts predicted far-reaching consequences to Europe’s funding market. The market for new AT1 bonds will likely go into deep freeze, traders said.

Perpetual notes issued by Deutsche Bank AG, Unicaja Banco SA, Raiffeisen Bank International and BNP Paribas SA all dropped by more than 10 points on Monday. Deutsche Bank’s £650 million ($792 million) 7.125% note dropped as much as 17 pence to about 64, its biggest-ever one-day decline. Most other European lenders’ Additional Tier 1 (AT1) notes fell to record lows.

Read more at: ZeroHedge.com

Submit a correction >>

Tagged Under:

AT1, banking, big government, bonds, Bubble, chaos, Collapse, Credit Suisse, debt bomb, debt collapse, economic riot, economy, finance, financial crisis, investment, market crash, money supply, panic, risk, stocks

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS