Fed Chair warns U.S. could see unexpectedly high interest rate hikes soon

03/09/2023 / By Cassie B.

The chairman of the Federal Reserve, Jerome Powell, warned this week that interest rates will likely be higher than policymakers at the central bank previously anticipated.

He cited data showing that inflation has now reversed the deceleration experienced late last year.

Powell stated: “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.

“If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Their aim is to try to reduce inflation to a target of 2%; higher interest rates are expected to reduce consumer spending, which would slow the economy. However, the Fed has already raised interest rates at the quickest pace since the 1980s during the last year, climbing from almost 0 to over 4.5%. Despite this, consumer spending has not been slowing.

Higher rates are expected to negatively impact stocks and other investments and increase the risk of a recession down the line.

Following Powell’s announcement, stocks sank, with the S&P dropping 62 points and the Dow Jones Industrial Average closing 575 points lower. NASDAQ, meanwhile, dropped 1.3%.

When the Federal Open Market Committee meets again toward the end of the month, another increase is widely expected, and the hike could be in excess of 50 basis points. There remains considerable uncertainty about where rates will fall by year’s end.

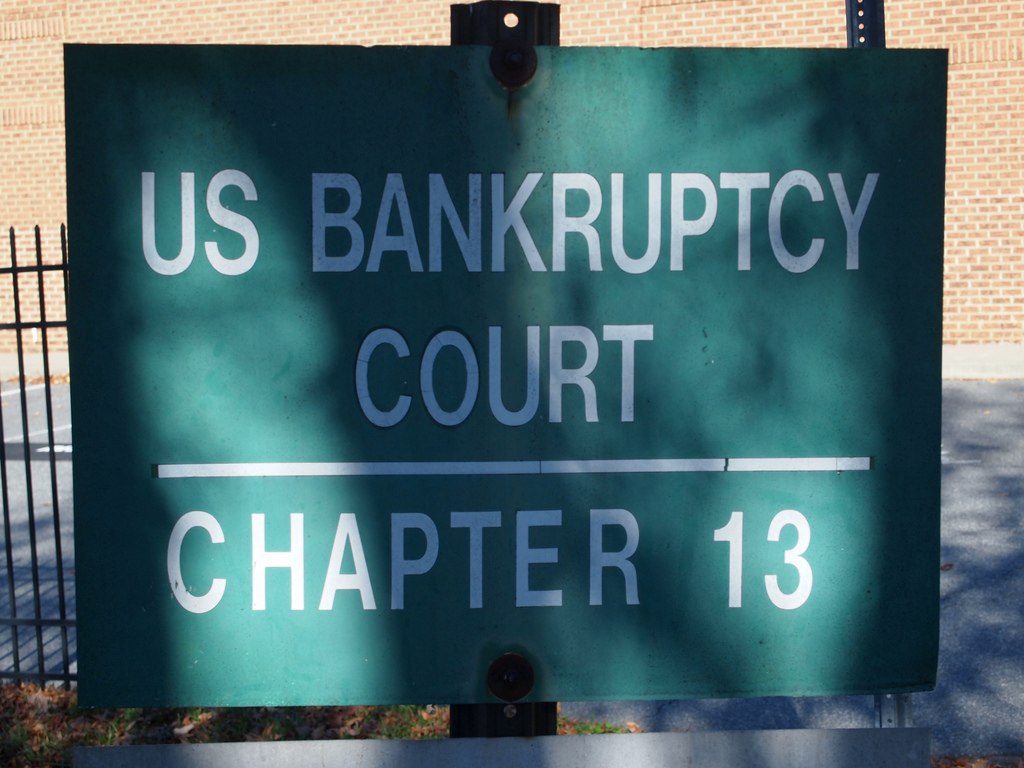

The impact of these moves on small businesses could be significant. Companies using loans with a flexible rate have seen the rates on their small business loans double in the span of just one year, while some businesses are paying more than 10% interest on their existing loans. This is hurting profitability and cash flow for the businesses that are already paying off loans and causing other businesses to delay their plans for expansion.

Federal funds rate could hit 6%

Just how high could the rate move? Rick Rieder, a managing director and chief investment officer for asset manager BlackRock, told CNBC that he believes the federal funds rate could peak at 6 percent.

He commented: “We think there’s a reasonable chance that the Fed will have to bring the Fed Funds rate to 6%, and then keep it there for an extended period to slow the economy and get inflation down to near 2%.”

He said the economy has been more resilient than anticipated, as evidenced by the latest Consumer Price Index reading and jobs report. This resilience, he noted, is making things complicated for the Fed as the economy is not as sensitive to interest rates as it was in the past.

The last jobs report saw a rise of 517,000 nonfarm payrolls in January, which was well above market estimates. Unemployment, meanwhile, fell to 3.4%, which is its lowest level since 1969. The next report will be out tomorrow and is expected to continue pointing to a resilient labor market despite the recent aggressive rate increases.

This will be followed by updated consumer price data on Tuesday.

The results of these and other upcoming data releases will indicate whether last month’s hotter-than-expected figures were a fluke or a sign of things to come. Many experts believe we could see a rate rise of half a point, although Powell has insisted that a decision has not yet been made.

In congressional testimony this week, he said: “We’re not on a preset path. We will be guided by the incoming data and the evolving outlook.”

The next Fed meeting is scheduled for March 22.

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, Bubble, debt bomb, debt collapse, economic collapse, economic riot, Federal Reserve, finance riot, Inflation, interest rates, Jerome Powell, market crash, market reset, money supply, pensions, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS