Study finds that overwhelming majority of Bitcoin trading volume is faked

03/25/2019 / By News Editors

The great bitcoin bull market of 2017 wasn’t the first bubble in the pioneering digital currency’s brief lifespan, and it might not be the last, but to this day, these losses still hurt, and what’s worse, for many of those who had chosen to hold on, coins have been stolen or lost thanks to hackers and con artists, who for years operated with near-impunity (though this is finally beginning to change).

(Article by Tyler Durden republished from Zerohedge.com)

For these (and myriad other) reasons, attempts to legitimize bitcoin have largely floundered. Trading in bitcoin futures has fallen off a cliff, while the SEC has continued to resist the creation of a bitcoin-focused ETF. Perhaps the biggest disappointment of all was the Grayscale Bitcoin Trust, which allowed anyone with a brokerage account or IRA to gain exposure to bitcoin (but for a massive premium). During the crash, it delivered huge losses.

Yet, since the beginning of the year, desperate bulls have found some justification to keep hanging on. Over the past few months, the digital currency has slowly crept higher. A drumbeat of negative headlines, including one warning that the majority of bitcoin exchanges had likely turned a blind eye to suspicious activity, have had little impact.

Still, suspicions endure. Whether it’s Bitfinex using tether to prop up bitcoin prices, or a handful of ‘whales’ colluding to push prices in their favor, theories about widespread manipulation in the bitcoin market have festered for years.

And in the latest blow to crypto’s credibility, the Wall Street Journal reported on Friday – citing data from a research firm that has been closely monitoring trading activity across dozens of exchanges – that the vast majority of bitcoin trading volume is an illusion – likely faked by the exchanges themselves using cunning trading algorithms to give customers the false impression of a deep, liquid market.

Oddly enough, Bitwise Asset Management, the firm that carried out the analysis, sent its findings to the SEC with the hope of convincing the regulator to finally drop its opposition to a bitcoin ETF (the firm is hoping to launch one that would limit trading to exchanges that don’t manipulate trading volume).

Over the course of four days in March, Bitwise analyzed the trading activity at 81 exchanges, and discovered suspicious patterns that analysts said suggested that much of the activity was being generated by programmatic trades intended solely to the inflate the exchange’s perceived volume. This, in turn, helped the exchanges game the rankings on websites like CoinMarketCap (which, in theory, should lead to more business), the analysts concluded.

The San Francisco-based company submitted its research to the U.S. Securities and Exchange Commission with an application to launch a bitcoin-based exchange-traded fund. The study, made public Thursday, is an attempt to alleviate the agency’s longstanding concerns that a bitcoin ETF would leave investors exposed to fraud and market manipulation.

Bitwise’s fund, if approved, would be based upon the 5% of trading it considers legitimate, said Matthew Hougan, Bitwise’s head of global research. That volume comes from 10 regulated exchanges that can verify that their trading data and customers are real. This slice of the market, he said, is well regulated, transparent and efficient.

“I hope everyone sees there is a real market for bitcoin,” he said.

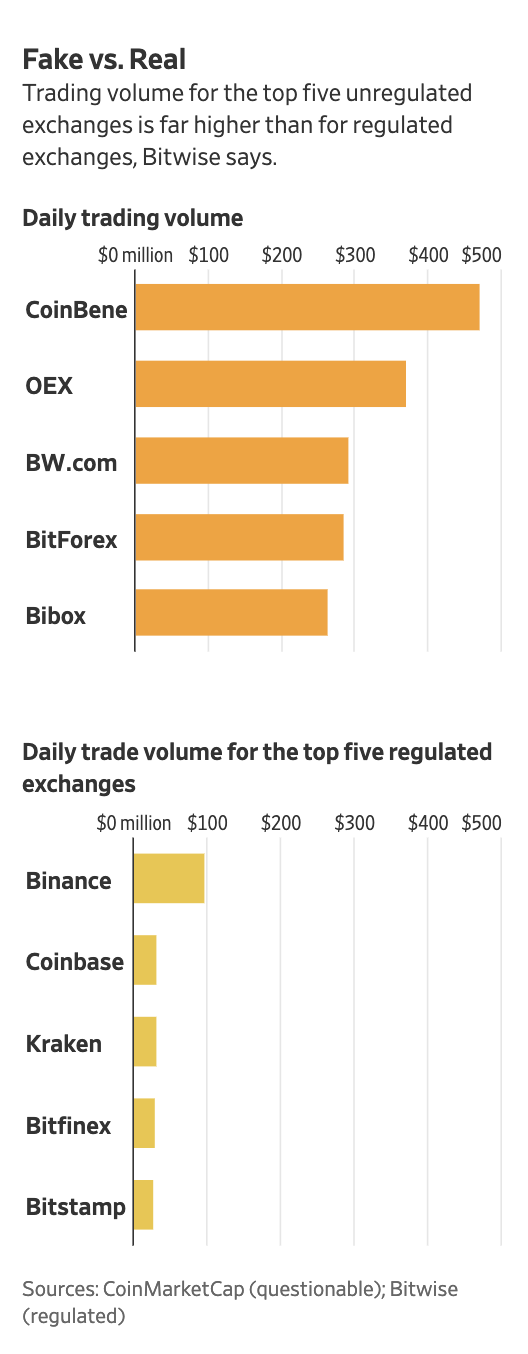

When Bitwise ran its analysis, it found that 71 of the 81 exchanges it examined harbored activity that appeared fraudulent. Of the $6 billion that changed hands during the study, Bitwise calculated that only $273 million in volume appeared legitimate. The overwhelming majority of the fraudulent activity appeared to take place on newer, unregulated exchanges like Coinbene and BiBox, two of the examples listed by WSJ.

Some of the suspicious patterns Bitwise identified included a surprising number of trades being executed within the bid-ask spread, buy and sell orders cancelling each other out, and volumes that were steady throughout the day (rather than registering peaks and valleys during normal trading hours).

Bitwise created a program to collect and analyze trading data across 81 exchanges, looking for patterns that exemplified both real and artificial trading. It concluded that 71 of the 81—or 95% of reported volume—are questionable, with patterns that indicated the trading on them appears manufactured.

Of the roughly $6 billion in reported daily volume during four days in March, the firm calculated that about $273 million was legitimate.

On regulated exchanges such as Coinbase, Gemini, BitFlyer and Poloniex, trading followed certain patterns, according to the Bitwise report. Trading volume, for example, rose and fell at predictable times coinciding with working and sleeping hours. Smaller trades were more frequent than larger ones, and many were in round numbers. All those patterns reflect how human traders think and act.

By contrast, the dozens of unregulated exchanges that have cropped up over the past year show different trading patterns. Buy and sell orders appear in pairs, with one neutralizing the other. Trades are almost always executed within bid and ask prices, indicating a lack of the more haphazard decision-making one would expect from human traders. There are very few small or round-number trades. Volume is consistent across the trading day.

The unregulated exchanges also show massive volume. Coinbase, the largest of the regulated exchanges, had average daily volume of around $27 million in the first week of March, when Bitwise collected its data. By comparison, CoinBene, a newer exchange that first appeared in October 2017, reported $480 million in daily volume over the same period. Yet CoinBene’s website attracts far less traffic than Coinbase, which is in 55,097th place by Amazon’s Alexa ranking service, compared with 1,500th for Coinbase.

Of course, if such a large percentage of trading in bitcoin, the oldest cryptocurrency, and the one with the broadest appeal, is fraudulent, just imagine what that means for the alt-coin market.

Read more at: Zerohedge.com

Tagged Under: bitcoin, Collapse, crypto, cryptocurrency, currency, decentralization, decentralized, deception, dormant, fiance, investors, Liberty, money, risk