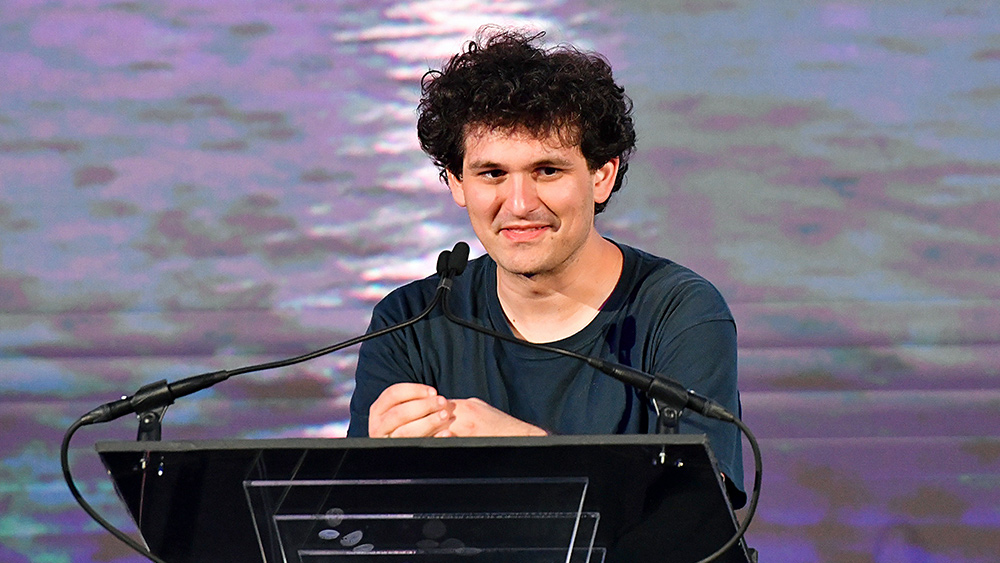

FTX founder and Democrat super donor Sam Bankman-Fried lent $1 billion to himself through his hedge fund

11/18/2022 / By News Editors

Disgraced cryptocurrency exchange FTX founder and Democrat super donor Sam Bankman-Fried lent $1 billion to himself through his hedge fund Alameda Research, which likely sourced the money from FTX customer funds.

(Article by Alana Mastrangelo republished from Breitbart.com)

On Thursday, it was revealed by FTX’s new CEO John Ray, III that the collapsed company’s bankruptcy filing shows it had lent billions of dollars in customer funds to Alameda Research. Among those loans, a staggering $1 billion was made to Bankman-Fried himself.

According to Ray, Alameda had made $4.1 billion of related-party loans, which were still outstanding at the end of September.

In addition to the $1 billion loan that was made to Bankman-Fried, FTX co-founder Nishad Singh received a $543 million loan, and the company’s co-CEO Ryan Salame received a $55 million loan.

But this was not the only wild and shocking revelation found in the FTX bankruptcy filing. FTX corporate funds were also used to buy personal homes, audit opinions were conducted from the metaverse, and most of the company’s digital assets have not been secured, among other things.

The drama started last week, when Bankman-Fried told investors that FTX was facing a major shortfall of up to $8 billion from withdrawal requests and needed emergency funding.

That disclosure was later followed up with a bankruptcy filing in Delaware, Bankman-Fried announcing his resignation, as well as saying that Alameda Research would be shutting down. The disgraced FTX founder has since put his 12,000-square ft. penthouse in the Bahamas up for sale for nearly $40 million.

Bankman-Fried, who had an estimated net worth of $16 billion last week, is now completely broke, according to calculations by Bloomberg — an incident that the outlet referred to as “one of history’s greatest-ever destructions of wealth.”

Read more at: Breitbart.com

Submit a correction >>

Tagged Under:

Alameda Research, bankruptcy, Bubble, Collapse, conspiracy, corruption, crypto, cryptocurrency, deception, FTX, investor funds, market crash, money supply, Nishad Singh, risk, Sam Bankman-Fried, traitors

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS