Russian central bank to launch pilot program for digital ruble by 2023

05/31/2022 / By Arsenio Toledo

The Central Bank of Russia is on track to begin its pilot project using a digital ruble. This project will involve real customers and real transactions.

Western sanctions that have escalated since the beginning of Russia’s invasion of Ukraine have cut the country off from large parts of the global financial system. Since then, the Kremlin has been looking for alternative ways to make key payments both at home and abroad and to maintain their crucial connections with the financial systems of countries that continue to trade with them. (Related: Russia is considering bringing back the GOLD STANDARD to maintain financial sovereignty amid economic sanctions.)

The digital ruble project is set to launch its pilot program by 2023, according to Central Bank of Russia Governor Elvira Nabiullina.

The governor further stated in an address to the State Duma, the lower house of Russia’s federal legislature, that the central bank currently has a prototype of the central bank digital currency (CBDC) that it was testing with other Russian banks.

“The digital ruble is among the priority projects,” said Nabiullina. “We have fairly quickly created a prototype. Now we are holding tests with banks and next year we will gradually have pilot transactions.”

Once Russia fully rolls out the CBDC, Nabiullina noted that the digital currency could be used in some international transactions.

The pilot program will involve digital currency transactions with other central banks around the world that are still willing to do business with Russia despite Western sanctions.

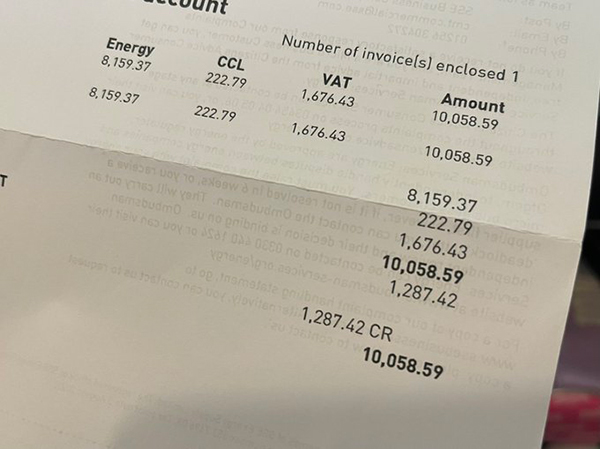

The central bank’s broad vision for the digital ruble is that fund transfers between individuals will be done free of charge. Transactions using the CBDC may attract a commission of between 0.4 to 0.7 percent.

The complications to the launch of the CBDC are still being worked out. First Deputy Chairman of the Central Bank of Russia Olga Skorobogatova recently remarked that some Russian banks, including some that have expressed their willingness to participate in the pilot program, are still not ready to join the tests.

However, Skorobogatova insisted that these concerns should not affect the timing of the project.

Assuming that the first stage of the pilot program for the digital currency succeeds, Skorobogatova noted that in the latter half of 2023 the central bank will proceed with the second phase of its trials.

During this phase, the bank will launch operations allowing Russian nationals and entities, including government agencies, to pay for goods and services with digital rubles.

Russia to continue building up digital assets

In response to Western sanctions, Russia is continuing its push toward broadening the availability of digital financial services.

In response to being kicked out of SWIFT, an international monetary messaging platform, payment service providers like VISA and Mastercard have also ended providing services to Russian banks.

Russia’s solution to this is the MIR banking card, an alternative banking card that it is offering to countries that are still willing to trade with Moscow.

MIR and UnionPay, a Chinese banking card, are among the few options left for Russian citizens and entities to make international transactions since Russian banks were isolated by sanctions.

Much of the international digital assets industry has been implored by Western powers led by the United States to completely cut off Russia and not engage with the country’s financial services industry. The International Monetary Fund (IMF) warned that Russia could use cryptocurrencies like bitcoin to evade sanctions.

The U.S. has even expanded the number of Russian entities on its sanctions list to include BitRiver and its subsidiaries. BitRiver is a Russian company that mines new bitcoin blocks.

Similarly, the European Union’s regulations have forced Binance, the world’s largest digital assets exchange, to announce that it is winding down the services it provides to Russian nationals and entities.

These and other efforts by the West to close any loopholes Russia could use to circumvent sanctions will likely fail, especially if Russia’s forays into creating independent digital assets and financial services platforms succeed.

Learn more about the rise of ruble and other currencies at CurrencyReset.news.

Watch this video as journalist Rachel Blevins explains how Western sanctions backfired and empowered the ruble.

This video is from the Marine1063 channel on Brighteon.com.

More related stories:

Russian ruble is year’s best-performing currency.

Russia’s actions against the dollar could spur economic collapse for America.

Russian banking system and ruble are showing signs of strong recovery despite sanctions.

Sources include:

Submit a correction >>

Tagged Under:

big government, Bubble, chaos, currency crash, currency reset, digital currency, digital finance, digital ruble, economic sanctions, economy, finance, financial services, money supply, national security, risk, Russia, Russia-Ukraine war, World War III

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS