China’s electronic money may bring surveillance state to private wallets worldwide

10/31/2021 / By Virgilio Marin

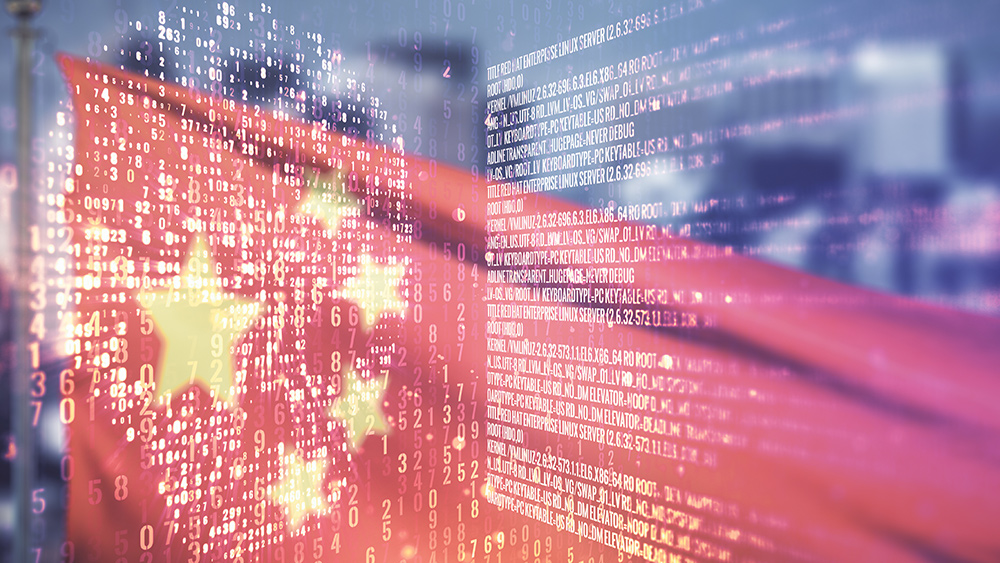

Experts warn that China’s emerging digital currency can extend the country’s surveillance activities into public and private wallets worldwide and undermine the dollar’s status as the currency of choice for global business.

The Chinese Communist Party (CCP) is currently developing a digital yuan, a national digital currency that can only be owned and transacted by using computers or electronic wallets connected to the Internet or other designated networks. Like standard yuan that exists in banknotes and mint coins, digital yuan will be issued and regulated by the People’s Bank of China (PBOC), which is the country’s central bank. Hence, digital yuan will assume the status of legal tender to become China’s so-called “Central Bank Digital Currency” once it is implemented.

The digital yuan differs from cryptocurrencies such as Bitcoin in that it is state-controlled. The latter are virtual currencies, an unregulated form of digital currency that is under the control of the currency developer, founding organization or defined network protocol, instead of a centralized regulator like a central bank.

While the digital yuan is only in the pilot phase, pundits are sounding the alarm because it will permit the Chinese surveillance state to spy on transactions made by private entities that use the electronic money.

“There’s no anonymity, which [means] the central bank and the central government is going to watch you and how you spend your money,” former U.S. Department of Commerce Assistant Secretary Nazak Nikakhtar explained. “It’s programmable.”

But PBOC says that the digital yuan will have a feature called “controllable anonymity,” which it claims will both protect users’ personal information and allow Beijing to monitor for illegal activities. This is made possible by what PBOC describes as a “loose coupling of accounts,” in which users’ current bank account will maintain a tenuous connection to their digital yuan account. Such a connection may take the form of the users’ phone number and will allow Beijing to track transactions.

The PBOC will also mandate agencies that operate digital yuan services to submit transaction data to the central bank via asynchronous transmission on a timely basis. This mandate will allow the PBOC to “keep track of necessary data” in order to crack down on money laundering and other financial crimes, the central bank claims.

But the digital yuan is also a powerful tool that will no doubt increase the CCP’s robust surveillance capabilities, The Wall Street Journal noted. Beijing has hundreds of millions of facial-recognition cameras that it uses to spy on its population, sometimes using these to impose fines for activities such as jaywalking. A digital currency may also have this function, but unlike the spy cameras, it will allow Beijing to mete out and collect fines as soon as it detects an infraction.

Chinese digital currency will harm the dollar

The digital yuan also has vast implications for the future of the dollar, which is the world’s principal reserve currency. This is a foreign currency that a central bank or treasury holds as part of its country’s formal foreign exchange reserves.

As the main reserve currency, the dollar is the most widely used currency for international transactions. This high global demand allows the U.S. to borrow money at a lower cost and amplifies the power of its financial sanctions. But the country can lose these advantages over time once China rolls out the digital yuan.

More and more people and organizations from other countries are expected to embrace electronic money, as hinted by the rise of cryptocurrencies and digital wallets. As China is the first major economy to digitize fiat currency, the digital yuan has all the potential to become the currency of choice in the global financial market, threatening the dollar over the long term.

“They’re just trying to create an alternative,” Nikakhtar said. “This is basically creating an epicenter and hoping [that it’s] like a magnet that draws everything out from the United States towards this other center.”

A European central banker said that Western central banks are now experiencing the anxiety that permeated traditional taxi systems when Uber, a pioneering ride-sharing platform, arrived at the scene. “There is a sort of Uber fear,” the banker told The Wall Street Journal. “You don’t want another country’s currency circulating among your citizens.”

“The digital yuan would enable emerging economies to swiftly and conveniently carry out payment and settlement operations at low cost,” Japanese news outlet Kyodo News, quoting a Southeast Asian central banker, reported. “The possibility cannot be ruled out that the yuan will rapidly build a position as key currency in a China-led economic zone.”

Follow CommunistChina.news for more on Beijing’s efforts to challenge America on a global stage.

Sources include:

Tagged Under: banking, bitcoin, Central Bank Digital Currency, central banks, China, Chinese Communist Party, communist China, cryptocurrencies, currency, digital curency, digital currency, digital wallet, digital yuan, digitization, dollar, economic collapse, electronic money, finance, financial technology, mass surveillance, Orwellian, People's Bank of China, privacy, reserve currency, spying, surveillance, surveillance state, technology, trade, Us Dollar, yuan

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS