Microchip shortage affects production of new vehicles, leads to higher car prices

09/22/2021 / By Nolan Barton

Demand continues to outpace supply in the auto manufacturing industry as the ongoing shortage of microchips significantly impacts carmakers’ production of new vehicles.

The high demand spills over to the used-car market. “As is always the case, the new car and used-car markets are tied,” says Cars.com Executive Editor Joe Wiesenfelder. “High prices in one affect the other, and that’s where we are.”

The average price for a used vehicle has jumped more than 21 percent to about $25,400 from $20,900 a year ago. For new cars, buyers are paying roughly $40,800 – up by 4.9 percent year-over-year.

“It’s difficult to gauge how long it will take for things to improve. All of this relies on new-car inventory returning to healthier levels,” says Wiesenfelder. (Related: Chip shortage cripples car production amid high demand.)

COVID-19 pandemic causes additional demand in cars

The COVID-19 pandemic has also caused additional demand. Consumers sitting at home during lockdowns have amassed extra piles of spending money that they can now use as governments ease restrictions.

“The main reasons for cars increasing in value are an increase in demand from ‘accidental savers,’ or people not going on holiday as much or socializing as much over the past 18 months,” says Derren Martin, head of valuations at Cap HPI.

High-mileage cars sell high

Even vehicles with high mileage may fetch more. The average amount paid for cars with mileages between 100,000 and 109,999 rose last month by 31 percent to $16,489 from $12,626 a year ago, according to data from Edmunds.

Trucks topped the list of the biggest year-over-year increase in average prices in that high-mileage category. For example, the Chevy Silverado 1500 sold for an average $26,914 in June, a 49 percent jump from a year ago.

Monir Uddin is scouring for a replacement for his family’s diesel vehicle at a used car dealership in London. But soaring prices for second-hand cars are giving him cause for concern.

“The price is a bit too high. We’ll leave it as it is for six months or a year,” he said. “They haven’t got as many cars as usual around here now.”

He is one of many British consumers feeling the fallout from once-in-a-lifetime boom in the second-hand car market, with record numbers of consumers seeking to own or upgrade vehicles during the pandemic just as supplies in new cars have ruptured.

Brand new cheaper than second-hand

The rise in prices of second-hand cars was identified as a key driver of U.K. inflation in July.

“I’ve never seen anything like this,” says Mark Lavery, chief executive of Cambria Automobiles, a dealer group. “It’s an absolute freak set of circumstances.”

Britain’s Society of Motor Manufacturers and Traders has cut its forecast for new car registrations for 2021 by 24 percent, from 2.4 million to 1.8 million. Last month, it reported the worst July for UK automotive production since 1956.

It comes as a study by Cap HPI showed how 52 six-month-old vehicles with 5,000 miles on the clock gained in value significantly compared with when they are brand new.

The analysis has found that a second-hand Dacia Sandero is being advertised for £12,398 ($16,953), significantly higher than its average new price of £10,172.92 ($13,909). A Toyota Yaris GR is being advertised at £35,967 ($49,175) compared with its new price of £30,963 ($42,333).

According to car magazine Parkers, some second-hand cars are gaining almost £10,000 ($13,672) in value within five months of being sold.

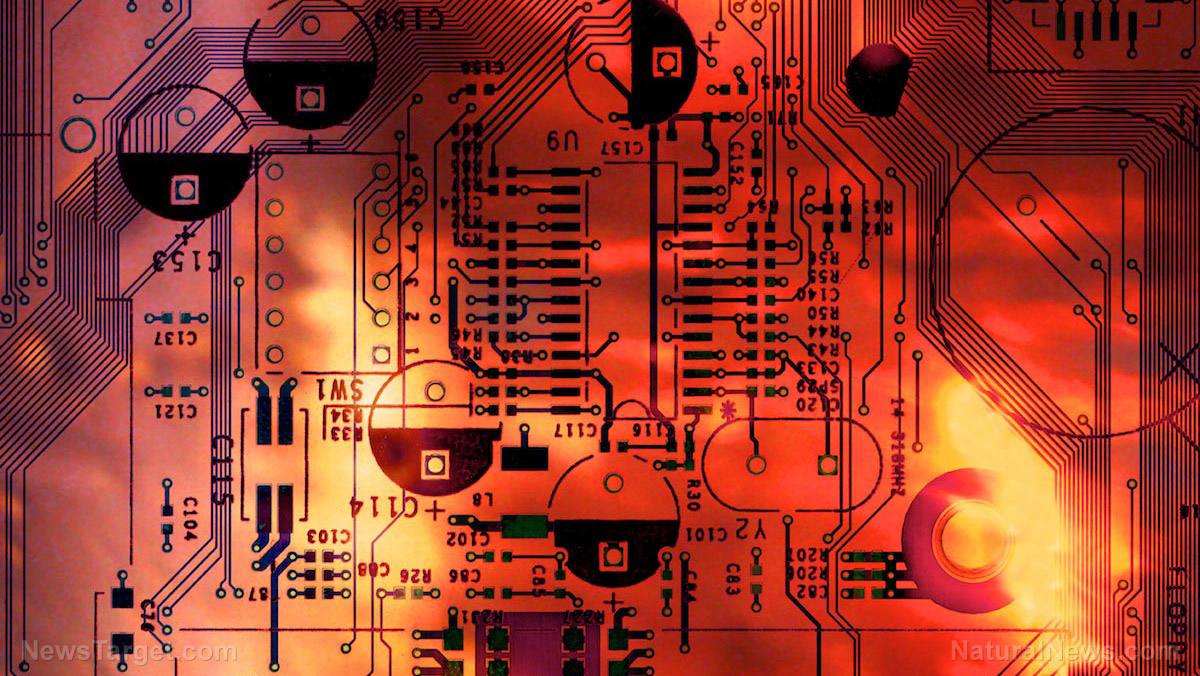

Several factors contribute to chip shortage

The microchip shortage stems from a confluence of factors.

Consumers have stocked up on laptops, gaming consoles and other electronic products during the pandemic, leading to tighter inventory. Sanctions against Chinese tech companies have exacerbated the crisis.

A fire at a Japanese chip-making factory owned by Renesas Electronics Corp., which accounts for 30 percent of the global market for microcontroller units used in cars, has impacted the car manufacturing industry. Meanwhile, severe winter weather in Texas has forced major automotive chip suppliers NXP Semiconductors and Infineon to shut down factories temporarily.

Originally concentrated in the auto industry, the chip shortage has now spread to a range of other consumer electronics.

Other industries impacted by chip shortage

South Korean tech giant Samsung says that the chip shortage is hitting television and appliance production, while LG admits the shortage is a risk.

“Due to the global semiconductor shortage, we are also experiencing some effects especially around certain set products and display production,” says Ben Suh, head of Samsung’s investor relations.

“We are discussing with retailers and major channels about supply plans so that we are able to allocate the components to the products that have more urgency or higher priority in terms of supply.”

LG says it is “closely monitoring the situation as no manufacturer can be free of the problem if it gets prolonged.”

Production of low-margin processors, such as those used to weigh clothes in a washing machine or toast bread in a smart toaster, has also been hit. Even dog-washing businesses are suffering. CCSI, which makes electronic dog-washing booths in the Illinois village of Garden Prairie, has been told by its circuit board supplier that the usual chips aren’t available.

Carmakers leave out high-end features due to chip shortage

The car industry, which relies on chips for everything from the computer management of engines to driver assistance systems, is still the hardest hit. Companies like Ford, Volkswagen and Jaguar Land Rover have shut down factories, laid-off workers and slashed vehicle production.

Richard Palmer, chief financial officer at Stellantis, has warned that the disruption could last into 2022. (Related: Intel CEO warns global chip shortage could persist for a couple more years.)

Some carmakers are now leaving out high-end features as a result of the chip shortage. Nissan is reportedly leaving navigation systems out of cars that would normally have them, while Ram Trucks has stopped equipping its pickups with a standard “intelligent” rearview mirror that monitors for blind spots. Renault is also no longer putting an oversized digital screen behind the steering wheel of certain models.

Follow Pandemic.news for more news related to the coronavirus pandemic.

Sources include:

Tagged Under: brand new car, Bubble, car industry, car manufacturer, car market, coronavirus, covid-19, covid-19 pandemic, global market, microchips, microchips shortage, pandemic, second hand car

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS