Chip shortage cripples car production amid high demand

05/19/2021 / By Virgilio Marin

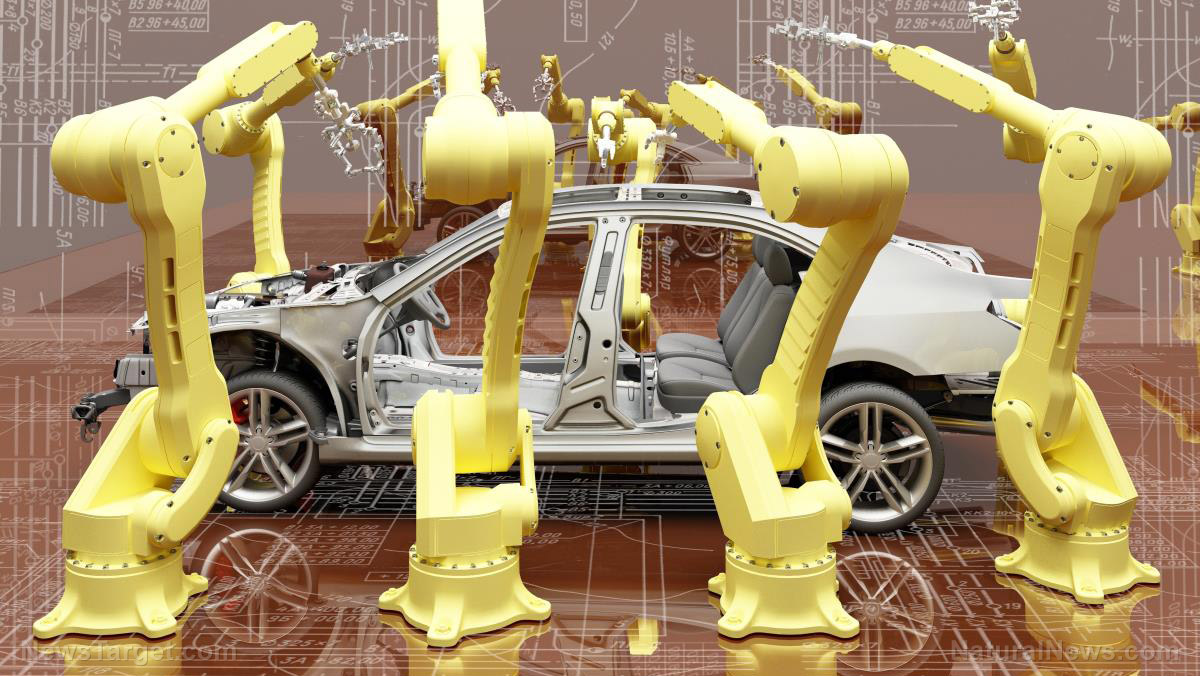

The global computer chip shortage has stalled vehicle production in dozens of factories across the U.S., driving up car prices amid high demand and causing temporary layoffs.

Research firm Autoforecast Solutions estimated that automakers cut the production of more than 1.2 million vehicles in North America because they couldn’t get enough microchips used for essential car components, such as safety systems, brakes and engines.

Dealer lots are now nearly empty while customers are forced to wait weeks or months for their orders to arrive. Justin Bates, a 42-year-old general contractor, has yet to receive his new GMC Sierra pickup truck after ordering it four months ago.

“I’m absolutely aggravated,” Bates said. “GM [General Motors] has 100 commercials going on for two or three months … yet nobody can provide a truck.”

At the same time, car dealers posted one of their best two-month stretches in March and April as Americans bought new cars in near-record numbers.

“We may just be in the greatest new-car market of our existence and we’re doing it with no cars,” Philadelphia-area car dealer David Kelleher told The Wall Street Journal.

Sales figures at his dealership increased over the last two months, but Kelleher is concerned about his prospects this summer because he is running low on stocks. He bared that only 98 vehicles are parked on his lot instead of the usual 700 heading into the summer.

“That really shook me up in a bad way,” he said. “This is going to be longer and more difficult than most people think.”

Demand pushed the average price for a new vehicle to $37,572 in April, up by nearly seven percent from last year and a record for the month, according to research firm J.D. Power.

Miami car dealer Ed Williamson disclosed that some models of GM’s Cadillac XT4 were priced at $5,000 above the sticker price. This came after the XT4 inventory dropped to roughly 2,000 nationwide last month, less than a third of the normal level.

Ford Motor Company’s car production was predicted to shrink in half in the second quarter after a fire last March took out its Japanese semiconductor supplier. Chief financial officer John Lawler said that the company expects to lose around 1.1 million units this year due to the chip scarcity. (Related: Fire at Japanese chipmaker adds to collapsing microchip supply lines for automakers.)

In all, dealers had fewer than two million vehicles on the ground or en route to stores at the end of last month. That was roughly half the normal number and the lowest level in more than three decades, according to research firm Wards Intelligence.

Automakers making chip-less cars, closing factories amid chip shortage

Some car companies dropped certain features that require scarce semiconductors to circumvent inventory shortages. GM, for instance, said that it was making some full-size pickup trucks without the software that manages fuel consumption.

“By taking this measure, we are better able to meet the strong customer and dealer demand for our full-size trucks,” a spokeswoman for the company said.

Stellantis N.V. also shipped some Ram pickup trucks to dealers without an electronic blind-spot detection system, according to Kelleher. He said that one buyer abandoned his purchase because the $60,000 truck lacked the feature. The buyer then returned hours later as no other car dealer had that truck. (Related: Top selling vehicles are being held back, made without computers as semiconductor shortage sweeps the globe.)

Meanwhile, other automakers made some models without computer chips and then parked them until the chips were available to install. Tens of thousands of these cars sat at airport lots, quarries, racetracks and other temporary holding pens near assembly plants in the South and Midwest.

Many car companies closed some of their factories or drastically reduced production capacity, forcing temporary layoffs. A GM factory near Kansas City, Missouri that made the XT4 had been closed since February as the company shuffled chip supplies to prioritize more popular models.

A Ford factory in Chicago that manufactured the Ford Explorer also went dark in the middle of last month. Assembly line worker Danyelle Anderson was among those put out of work by the shutdown. The single mother of four said that her check had been delayed by weeks, causing her to miss her rent, car and cellphone service payments.

Car parts manufacturer Eypex Corporation had to cut the workweek to three days and reduce the workforce to about half from the start of the year after the closure of Ford’s Chicago plant, which is one of its biggest customers. At the start of the year, orders were so plentiful that its president had to help box shipments on the factory floor.

Read more stories about the global semiconductor shortage at MarketCrash.news.

Sources include:

Tagged Under: automakers, car prices, cars, chaos, chip shortage, Collapse, computer chips, corporations, economics, economy, ford, General Motors, layoffs, manufacturing, market crash, microchips, semiconductor shortage, semiconductors, shortages, transportation, unemployment

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS