Manhattan restaurant forced to close as owner can’t find workers

04/04/2021 / By Nolan Barton

Slovenian restaurant Pakerna in Upper West Side, Manhattan was forced to close two weeks after its opening in December last year not for lack of customers but for lack of workers.

Waitresses that worked there left to become contact tracers, while bartenders went on unemployment. Owner Dean O’Neil was never been able to establish a solid workforce. On most nights, he’s only had one chef working in his kitchen.

“I couldn’t work out really why. And then I found it was basically they could receive money without having to work. Then they wanted to be paid only in cash. It’s unacceptable” said O’Neil.

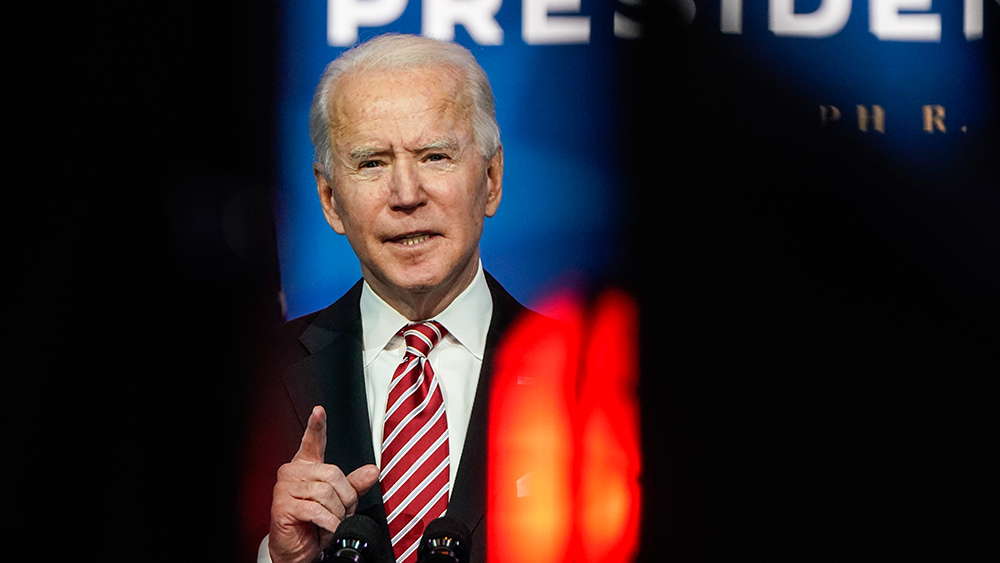

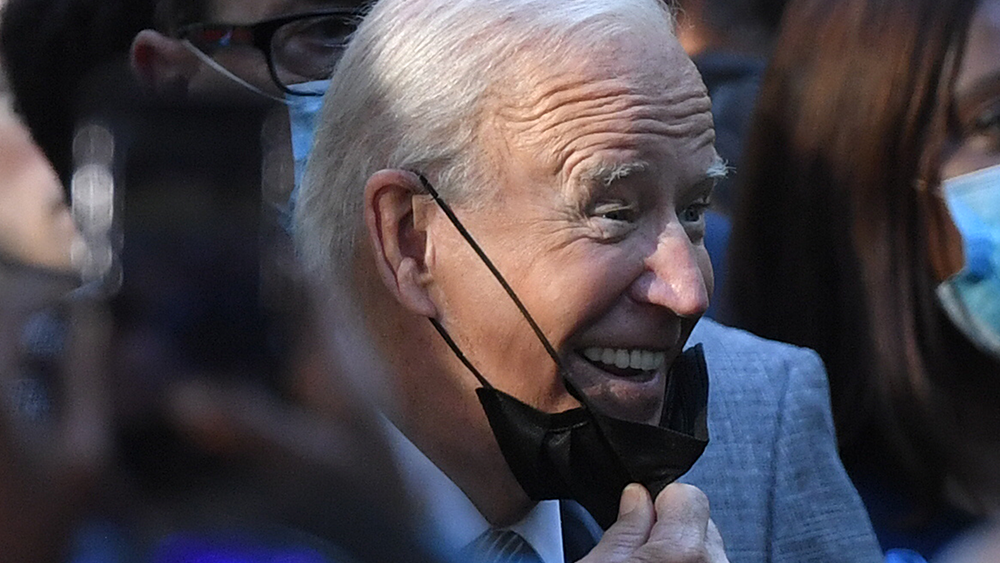

His workers took advantage of the $300 weekly enhanced unemployment insurance included in the Wuhan coronavirus (COVID-19) stimulus package signed by former President Donald Trump on December 27 last year. President Joe Biden extended the $300 per week unemployment insurance supplement up to Sept. 6 when he signed the $1.9 trillion stimulus package on March 11.

But long before the stimulus packages were signed, the CARES Act enacted in March 2020 provided a $600 weekly benefit on top of regular unemployment insurance benefits. Following the expiration of the supplemental benefit in July 2020, the Trump administration authorized an extra $300 per week federal payment.

Small businesses struggle to fill job vacancies

Owners of small businesses are starting to complain. They say it is now difficult to make people go back to work because of the generous federal aid.

A monthly survey by the National Federation of Independent Businesses (NFIB) showed that job openings in February reached an all-time record high, with 40 percent of businesses saying they are struggling to fill openings.

Mark Owens, who owns an insulation and a trucking company in Indiana, said the inability to hire people “has put a burden” on his businesses.

“Nobody wants to come and work,” said Owens. He said his businesses ran roughly 150 job advertisements from December last year until Feb. 15. Only three people showed up for an interview during that time, Owens said, and they only came to get proof that they were looking for a job and be eligible to claim benefits. (Related: Jobless claims fraud on the rise as coronavirus boosts unemployment.)

Mike Williamson, operations manager of a seafood restaurant in Washington, said he hasn’t even received any applications. Like other business owners in the area, Williamson has jobs available but few people are responding to the job postings.

“Getting extra money is not an incentive to work,” Williamson said. “When things were bad, I got it. But I’m convinced that is a problem now.”

Civil Knox, general manager and marketing director at Washington Crown Center, agreed.

“Our tenants are hiring but are short staffed,” she said. “It’s because there’s free money out there. You keep giving free money, why work? It’s beyond sad.”

Ron Smith, operations manager at Uniontown Mall, said that there were several instances where a candidate skipped the interview set up by the management. “People don’t want to work if they’re getting government money,” said Smith. “We can’t get employees.”

David Lamatrice, owner of Bistecca Steakhouse and Wine Bar, said his restaurant in the Meadows Racetrack & Casino has been looking to add staff with no success.

“We looked to add staff, but have had difficulty getting people to apply. We’ve had a problem with people who were to show up for an interview, but don’t, after fulfilling a UC requirement. I think some people are happy to get their unemployment and make it last,” said Lamatrice.

UC refers to unemployment compensation.

According to American Action Forum, a center-right policy institute, 37 percent of workers could make more on unemployment at the $300 level than they would earn by returning to work.

Lawmakers to introduce bill that will encourage people to work

Republican lawmakers led by Rep. Kevin Brady (R-Texas) announced that they would introduce legislation to help local businesses that face difficulties in hiring workers during the pandemic. The bill would encourage work by allowing states to turn enhanced unemployment benefits into a one-time hiring bonus. (Related: Coronavirus pushes unemployment to highest levels since the Great Depression.)

Other states can also follow the blueprint used by Idaho to offset the negative impact of the $600 weekly supplement last year.

Alex Adams, budget director for the state of Idaho, said that his state implemented “return to work incentives.”

He said the state paid a $1,500 bonus to each person who went back to work to incentivize work and help local businesses. Idaho distributed a total of $36 million in bonuses, which was paid for by the state’s discretionary portion of the CARES Act resources.

The state’s unemployment rate is among the lowest in the country – dropping to 3.4 percent in January from 11.6 percent in April 2020.

Follow Pandemic.news for more news and information related to the coronavirus pandemic.

Sources include:

Tagged Under: CARES Act, Collapse, coronavirus, covid-19, Donald Trump, economy, employment, Joe Biden, pandemic, Republican lawmakers, risk, small business, stimulus package, unemployment benefits, unemployment compensation, unemployment insurance, workers

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 RISK NEWS